ABSTRACT

Much greater cooperation between broadcasters, Internet content aggregators and mobile operators would enable the industry to address the business challenges and opportunities arising from current trends in TV and video consumption on personal devices.

Forecast growth in demand over the next 10-15 years could be met in a more affordable way by using new strategies to increase network capacity.

This paper outlines alternative technical solutions and revised business models to meet demand to the end of the next decade at lower cost, that’s both profitable for operators, sustainable for broadcasters and affordable to consumers.

INTRODUCTION

In the future of media (TV, radio, online content, games etc.), two trends seem inescapable - a sustained increase in data usage and much greater consumption of video on mobile and portable devices.

Both trends represent major challenges for many parts of the broadcast, mobile and broadband ecosystems.

Consumers will expect to access both free-to-view and purchased content on any of their devices wherever they are; the delivery mechanism won’t matter to them provided the quality is good, access is easy-to-use and the service is affordable.

DEMAND FORECASTS AND SPECTRUM PRESSURE

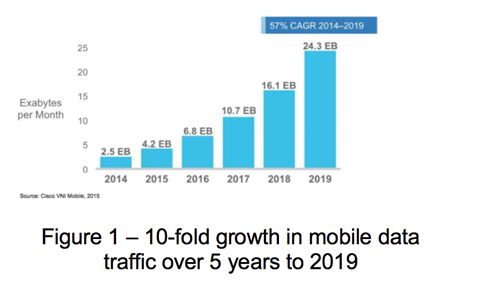

The latest forecasts from respected organisations, such as Cisco VNI, continue to show annual growth rates on mobile data of around 60% per annum, equating to a 10-fold increase in demand every 5 years1.

Although it’s highly unlikely that growth at this level will continue into the very long term, we can foresee it continuing well into the next decade, possibly easing off in 10-15 years as demand reaches 1,000-times current levels by 2030.

Daily TV and video consumption has been steady in many developed markets at around 4 hours per person for some years.

Recent data in the UK and US markets has shown a gentle decline of around 10% in total viewing on large screen TVs, with growth in viewing on tablets and smartphones largely offsetting that decline.

It could be argued that we’re seeing a rebalancing of viewing from large to smaller screens within a broadly steady overall level of daily usage.

Unconstrained access to TV services on small screen personal devices could lead to much more viewing over mobile networks, rising to as much as 25% (i.e. one hour per day or more), with the remaining 75% delivered over traditional broadcast and fixed broadband networks to small or large screens in the home.

By 2025, we could therefore see average mobile users consuming between 1GB and 4GB per day in total for all services over mobile networks, assuming the trend in video codec efficiency improvement continues at a similar rate to that experienced over the past 10 years. Moreover, broadcasters will want their content to be available for viewing on these smaller-screen devices, both at home and out and about.

IMPLICATIONS OF CONTINUING WITH CURRENT MOBILE DATA TECHNIQUES

Mobile operators, broadcasters and other content distributors will all find that their existing business models and cash flows are under pressure from the pace of change in consumers’ behaviour and the trend towards a significant proportion of viewing moving to handheld devices.

Opportunities for Mobile Operators

The market for mobile network services has reached maturity in many nations and the opportunity for network operators to increase total network services revenue is heavily constrained. Independent forecasts suggest annual growth of around 3% can be expected.

Consumers are looking for their increasing consumption of mobile data to be delivered at little or no extra cost in an increasingly competitive market. Currently, following the roll out of 4G networks, many operators may have under-utilised capacity.

Current technologies and planned improvements can probably meet the forecast 10-fold growth in demand over the next 5 years. However, to meet the 100-fold growth by 2025 there would need to be higher capital investment by operators.

With constrained revenues, operators’ profit margins and cash flow could be better sustained using radical, new solutions. Operators can take the lead in reshaping their cost base using these alternative technologies and effective new business models to secure a profitable future.

No comments yet