The broadcast and media technology market global revenue grew in 2016, with products and services reaching $50.97 billion.

The rise in revenue follows a significant decline in 6.3% of total broadcast and media technology revenues recorded in 2015.

Overall market revenues in 2016 reduced to figures last recorded in the 2010-2011 annual cycle, however, the aggregated revenues across all media technology products and services in 2016 was up 2.3%.

The results were published in the 2017 Global Market Valuation and Strategy Report (GMVR) produced by IABM DC, a joint venture between IABM and Devoncroft Partners publishing the annual market segmentation, sizing and forecasting reference for the media technology sector.

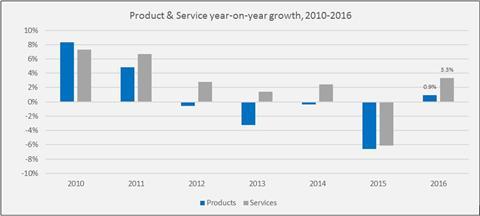

IABM DC revealed upon reviewing these results the gap between products and services continued to widen through 2016, a trend that first appeared in 2011, see: Figure 1.

The total industry was represented by hardware and software products at 43.3% in 2016, up 0.9% from 2015, at $22.07 billion.

The compounded annual growth rate (CAGR) of product revenues from 2012-2016 was down at -2.08%.

Revenues from services accounted for 56.7% of the total industry in 2016, or $28.91 billion, up 3.3% compared with 2015.

The CAGR of services revenue from 2012-2016 was 0.20%.

IABM Chief Executive Peter White said: “The static overall market reflects the change to new business models and the change in product mix that the market is going through at present.

“While the overall revenue potential of projects is reducing as software becomes the norm, their profit potential increases because of much lower material costs for vendors.

”We cannot compare the present-day industry with the one we were in even five years ago; this is a new market with plenty of opportunity for innovators.”

GMVR published significant market opportunities for workflow orchestration, which grew in 2016, OTT managed services increased by 17%, and the market for IP routers also continued to grow at a CAGR of 16.06% between 2012 and 2016.

While IP has yet to translate into a major spending driver for end-users, with all parts of the industry now working together on interoperability initiatives and with new, common standards and codecs coming online, the move to IP-based infrastructures is now beginning to gain momentum, as demonstrated by end-users buying intentions revealed in the latest IABM End-User Survey.

Although normal industry cyclicality and exchange rate fluctuations play a role in the newly published figures, a variety of other factors continues to impact the market, including:

- Certain end-users are implementing or planning for, a generational change in technology infrastructure (e.g. transition to IP-based systems, and the adoption of 4K for content creation and delivery)

- Standards for IP-based production and delivery systems are still yet to be finalised, potentially delaying projects while raising concerns over interoperability in multi-vendor deployments

- Government regulation continues to impact the industry in certain regions. These include mandates for localised content, issuance or delay of new broadcasting licences, auctions of broadcast spectrum, and next generation broadcast standards

- As consumer media consumption patterns evolve, and the number of OTT, streaming and S-VOD services increases, broadcasters are demanding technology solutions that are more agile and flexible. Some of these solutions require the establishment of new pricing and revenue models for both buyers and sellers of technology products and services

- Cloud-based solutions continue to improve for applications ranging from on-demand computing power, to play out, to archive, even as they decline in price

- Media companies are developing in-house solutions ranging from content management to advertising technologies, to OTT services that allow them to bypass traditional distribution outlets, and directly target consumers

Devoncroft Partners CEO Joe Zaller added: “The GMVR provides invaluable insights into the shifting structure of the broadcast and media technology market that will be of benefit every company operating in the sector.”

The report identified the shift from technology-driven change to business-drive change, “technology is only one component of the business transformation process for media companies, and today it is a means to an end, rather than an end unto itself.”

IABM Research Analyst Lorenzo Zanni exclusively shares IABM survey results show a shift in revenue from traditional to alternative platforms.

No comments yet