IBC2017: NBCUniversal today revealed plans to roll out its Hayu SVOD service to the Nordics, as delegates at IBC were told that future of TV is in platforms.

Easel TV Chief Commercial Officer Bill Scott, who chaired the Direct To Consumer stream, told IBC delegates that platforms are “are easier to launch, the technology is affordable and they understand their audience because of increasingly sophisticated data”.

The Hayu platform launched in 2016 and is currently available in the UK, Ireland and Australia.

NBCUniversal SVP-Branded on Demand Hendrik McDermott said that during the last quarter of the year it will launch with Norway’s TV 2, followed by expansion into Finland, Sweden and Denmark.

It follow recent announcements about extended distribution for Hayu via strategic partnerships in the UK with Amazon Channels, in Ireland with eir mobile and in Australia with Fetch TV. In 2018, Hayu will also launch on Now TV.

In a statement, McDermott said: “Launching in Norway is a key milestone for Hayu and the beginning of our international expansion plans.

“We have a dual goal of growing reach and distribution via both territory expansion and increasing our presence in existing markets via innovative partnerships.

Hayu uses social media to build awareness and new subscribers.

“Initially we promoted the service via our own web-site, and that generated a few thousand views. But now we use Facebook and Snapchat.

“One video achieved 21 million users, and converted subscribers at a cost of just $9.48 a sub. Another 12-second video generated 800,000 views, and gave us new subscribers at a cost of $4.66 a sub. If a video doesn’t work we kill it instantly.”

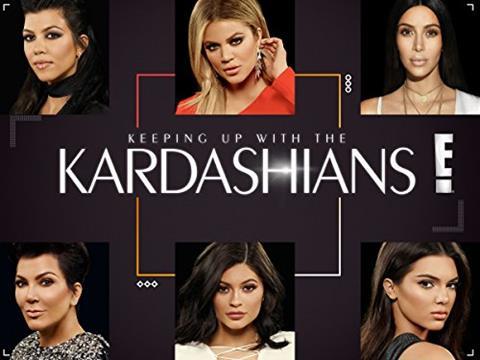

Hayu focuses entirely on Reality TV with some 4,000 hours and an additional 750 episodes a year being added. Content on the service includes Keeping Up with the Kardashians and its spin-offs along with The Real Housewives.

Richard Broughton, Research Director at Ampere Analysis, pointed to reality as one of the gaps in the OTT market. He said: “We all recognise the disruption that’s taking place. Direct to Consumer is an increasingly attractive business model.”

Broughton explained that SVOD/OTT revenues have grown extremely rapidly for the likes of Netflix, Amazon Video, Now TV and their local rivals, and are accelerating.

Last year global revenues were worth $16 billion. By 2021 they will be about $44-$50 billion. “These revenues are not always cannibalistic. Frequently, consumers add services to their existing pay-TV packages.

“In 2015, it was around 24% who had added an SVOD service. By Q3 this year that proportion had grown to 40%. But it isn’t all happiness for the established, and traditional, pay-TV operators.”

Netflix is taking the lion’s share (47%) of the cash being spent in OTT. Amazon is next (19%) and Hulu (in the US, about 9%).

“In other words three-quarters of overall revenues are taken by these three players. We are all aware that increasingly pay-TV is losing subscribers, and are mature and on a downward trajectory. There are obvious gaps in the OTT market, in sports, in reality and comedy.”

No comments yet