Legacy media and telecom players have been busy bulking up, but how will they capitalise on their scale to attract and retain more customers?

Over the past several quarters, the media industry has watched a raft of mergers and acquisitions, from AT&T’s takeover of HBO-owner Time Warner to Comcast’s audacious purchase of Sky and Disney’s acquisition of the entertainment assets of 21stCentury Fox.

The reasons behind all these acquisitions are pretty clear - scale, clout and reach - but now that the dust is beginning to settle on the prices paid and the auctions undertaken, what happens next? And, crucially, will the new beefed-up entities created by all these tie-ups be the right size and have the right focus to win in the changing media consumption and production eco-system?

It comes down to the question of what it takes to win in the new media ecosystem and, to be fair, the jury is still out on that one. Scale alone is probably not enough. But agility without some kind of outstanding USP isn’t enough either; the stakes are getting higher as companies bulk up, meaning an increasing amount of creative firepower is also needed in order to make your service stand out.

Webinar Why telcos need content and content providers need telcos

Clearly, the media business is undergoing big change and the merger mania is the result of changing media consumption. Led largely by the Silicon Valley giants from Google’s YouTube to Netflix and Amazon, the changes are offering more choices to consumers. And although the linear, live and catch-up TV experience still attracts the most viewing and the most advertising, over-the-top models are making gains.

In the US, traditional pay TV bundles are being abandoned - or at least scaled back - by subscribers who want a cheaper and easier service, usually called Netflix. Whereas there is less pay TV penetration overall in most European markets, the pressure on traditional media models is not letting up any time soon.

Netflix, as well as Amazon and Apple and others, are commissioning more and more original content while YouTube and Facebook are also rolling out increasing amounts of premium video alongside of user-generated content. So, do the newly beefed up legacy media and communications entities have the right mix of assets and the right focus?

“OTT offerings like Netflix and Amazon are increasingly looking to be included in platforms like Sky and Virgin Media…the lines between supplier and platform are blurring”

An early verdict on whether it was AT&T or Comcast that made the better deal in their respective recent acquisitions can be inferred perhaps from AT&T’s recent stock price fall. The shares fell just over 8% following AT&T’s first financial results after the closure of its 2016 deal to buy Time Warner. While the US pay TV business fell the promised synergies from owning Time Warner fell short. “The results this quarter reflected that AT&T isn’t quite yet the modern media company they have set out to become,” said Jonathan Chaplin, analyst at New Street Research at the time.

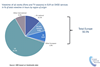

By contrast, Comcast’s pricey purchase of Sky has been seen by analysts as a re-setting of the US company’s business because it opens up whole new markets in Europe. In buying Sky, Comcast has added complementary media and telco assets and vastly increased its scale internationally, more than doubling its international revenues from 9% to 25% over a footprint that now has over 50 million customers, according to Enders Analysis.

In October, AT&T announced it had lost nearly 300,000 television subscriptions in the three months ending in September, pulling down profits and putting a question mark over how the largest US telecoms group is faring as it tries to keep pace with consumers who are abandoning traditional pay TV bundles and taking video services from competitors like Netflix.

However, it is early days for the AT&T and Time Warner tie up: HBO’s premium commissioning and the treasure trove of Warner Bros and Turner content and TV channels makes AT&T a Hollywood player with access to talent and programming to make it stand out. Indeed, Time Warner, now rebranded to Warner Media, posted a 6.2% rise in sales in the quarter, driven in part by the box office hit Crazy Rich Asians.

Like Bob Iger at Disney, Randall Stephenson, CEO of AT&T, is keen to get into the OTT business in a big way. Stephenson has put Warner Media on notice that it needs to ramp up the number of programmes and films it produces to keep pace with Netflix and others. Currently, HBO spends $2.5 billion to Netflix’s $8 billion on content per year.

SVOD launch

The telecoms giant will also launch a new, on-demand, subscription streaming service in late 2019 based around HBO and Warner Media’s other film and TV content, which includes the Harry Potter franchise and Batman as well as networks including CNN, TNT and TBS.

The new as yet unnamed SVOD service will also include acquired content and be offered at a higher price point than HBO Go, the current OTT service, which will continue. “We expect to create such a compelling product that it will help distributors increase consumer penetration of their current packages and help us successfully reach more customers,” John Stankey, CEO of Warner Media, told a Variety New Establishment Summit in October.

Meanwhile, Sky’s de-listing from the stock market last week coincided with the first Town Hall meeting of top Comcast and NBC Universal officials with Sky executives at the company’s Isleworth headquarters in West London.

Comcast CEO Brian Roberts praised Sky for its strategy and growth plan, promising a “hands -off” approach to how Sky is run as well as keeping its current CEO Jeremy Darroch in post. He underlined the importance of a big 50 million plus subscriber base, as well as synergies around innovation, purchasing, relationships and new products.

Both Roberts and Darroch underlined the big potential to grow in under-penetrated pay TV markets in Europe, including current Sky markets Italy (24% pay TV penetration) and Germany (19% pay TV penetration).

There is also a clear strategy to distribute services on all platforms, for DTH to mobile to OTT. Sky’s Darroch told analysts that launching more OTT services like Sky Now is on the cards, including in countries where Sky does not currently own telecommunications infrastructure like Spain and Switzerland where Sky has launched its OTT services in the last year.

Plus, Darroch says that Sky has put in place a “new strategic OTT streaming platform, which would allow us to light up any other country very, very quickly,” he said. “We’ll decide, as and when is the right time to do that and what’s the right brand to use. But I think all of the building blocks from a European point of view are coming in place.”

Sky and Comcast produce and sell programmes and own independent producers like NBCU’s Carnival Films, the maker of Downton Abbey and Sky’s 70% stake in Love Productions, the maker of Great British Bake Off. Putting the NBC Universal international studios division together with Sky Vision should help Sky with international sales of shows like Gomorrah and Fortitude.

According to Mathew Horsman, joint MD at Mediatique, the key dynamic that may determine who “wins’ in the media landscape going forward may come down to a binary choice between a focus on the platform or a focus on being a supplier.

In this equation, a platform is all about speed and quality of delivery as well as navigation, data usage and landing pages, whereas suppliers are all about owning the content.

In this scenario, Netflix and Disney are suppliers with Disney deciding not to sell its content to Netflix in order to beef up Disney+, its own OTT service that will house brands including Disney, Pixar, Marvel and Nat Geo that will launch in 2019 with a host of Star Wars spin offs.

By contrast, Comcast/Sky and ATT/Warner Media are more heavily invested in the platform, with cable, broadband, DTH and mobile assets and some content to help drive that.

“I think the big question going forward is who is going to have the whip hand,” said Horsman.

“Is it the supplier of content or the platform provider? I think what we have seen so far with the Comcast/Sky and the ATT/Warner Media deals is they are both figuring it’s a mix of the two.”

Originally platform-less services, OTT offerings like Netflix and Amazon are increasingly looking to be included in platforms like Sky and Virgin Media in order to reach the next batch of potential subscribers. It means the lines between supplier and platform are blurring. Or maybe the moves by the Silicon Valley tech platforms to be included on legacy platforms means the platforms are gaining in clout?

Clearly, content supply and distribution platform are both going to continue to be battlegrounds going forward, at least in the short term.

For Comcast/Sky, there are crucial pending negotiations on the cards with key Hollywood studios including Disney and Warner Media as they try and renew content output deals that have been crucial to build the Sky customer base. Will Disney extend its no selling to Netflix mantra to Comcast/Sky? Add to the strategic imperatives that Disney was a thwarted Sky suiter.

There will likely be more roll-ups to come and not only around content. 5G licenses and broadband infrastructure will also be in the sights of the players as they carve out their future relationships with consumers and their wallets.

No comments yet