While addressability for on-demand and OTT might be well established delivering the same for linear TV is challenging, writes Karin Bergvall.

TV advertising markets across most of Europe are under pressure. Audiences are fragmenting across new platforms and devices, making it harder for broadcasters to deliver concurrent mass-reach.

Non-broadcast video businesses – especially the major internet platforms – are competing for audiences and ad spend, moving onto TV screens and ramping up their investment in TV-quality content.

Meanwhile, advertisers and agencies are increasingly data-driven, using richer, deeper data to plan campaigns and target consumers across multiple platforms.

The major internet media companies, despite their much-publicised data challenges, are helping to fuel this demand, offering common targeting platforms for large numbers of users, and moving towards third-party verification and auditing.

Taken together, these developments are stimulating a new wave of investment by TV platforms and broadcasters, to support better monetisation of multi-platform TV offerings and to roll out addressable TV advertising on TV platforms, for linear and on-demand content.

Today, European broadcasters and TV platforms have made various levels of progress in developing their addressable TV advertising capabilities.

However, addressability for on-demand content and OTT streaming is well established in most markets; the next goal is to deliver addressable advertising within linear broadcast TV.

Sky has spearheaded developments with its AdSmart product in the UK, and is now rolling it out to Italy and Germany – and conversations are happening throughout Europe between broadcasters and TV platforms hoping to enable similar capabilities.

Broadcasters hope to realise various benefits by rolling out addressable TV advertising: protecting TV ad spend from internet media competitors; gaining share from other broadcast sales houses; and bringing new advertisers to the TV ad market.

In many cases, broadcasters are also looking to generate increased revenues by applying rich consumer data to TV inventory and enabling the sale of previously unsellable TV inventory, such as zero-rated ad impressions.

There are still uncertainties in many markets about the scale of these opportunities, with many implementations to date involving smaller broadcasters and campaigns. However, industry experts are positive about the prospects for addressable TV advertising, seeing it as a “billion Euro opportunity”.

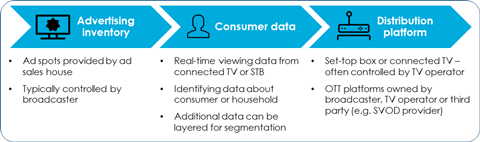

Implementation is challenging. TV solutions generally require a combination of consumer data, broadcast inventory and access to the TV platform to support client-side ad insertion.

On OTT platforms and catch-up hubs, the same company typically controls the ad sales and the underlying product and software platform, and also has access to customer data through cookies or registration walls.

However, ad sales and TV platforms are often controlled by different entities, requiring commercial collaboration between broadcasters and TV platform operators.

Developing commercial agreements will be key to implementation in many European markets.

One of the reasons for Sky’s early market entry is its vertical integration in the UK; in addition to operating the largest pay-TV platform reaching 9 million households, it also operates a sizable TV ad sales house.

The prospects for addressable broadcast TV advertising also vary market-by-market, depending on factors such as the size and value of the market, the ability of industry participants to invest and make a return, the regulatory environment and agency demand.

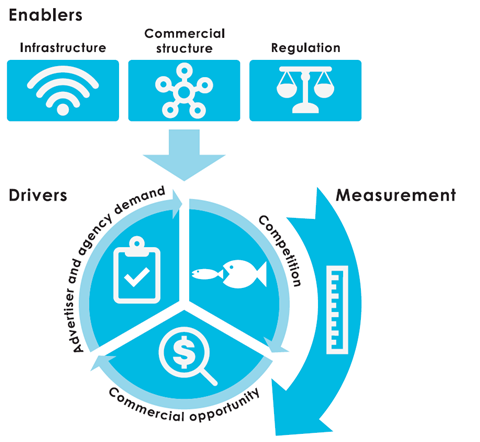

In a recent paper, prepared by MTM and Videology (a leading software provider for converged TV and video advertising) – TV Nations 2020: Prospects for Progressive TV Advertising in Europe – we set out seven inter-connected factors that will help to shape the prospects for addressable TV advertising in any given country:

- Market enablers – the underlying factors that are required for addressable TV advertising:

- Infrastructure: Penetration and fragmentation of connected TV sets or set-top boxes ready for addressable TV advertising

- Commercial structure: Ability to bring together ad inventory, data and distribution

- Regulation: Supportive data, privacy and commercial regulation

- Commercial drivers – the commercial rationale for a company to invest in addressable TV advertising:

- Competition: Level of need for addressable TV advertising to defend against competition

- Advertiser and agency demand: Levels and patterns of demand from agencies and advertisers for addressable TV advertising products

- Commercial opportunity: Size of opportunity and costs, time to make a return on investment

- Measurement – tools and solutions to track and attribute addressable TV ad products

The prospects and limiting factors for implementation vary by country. For example, French regulations currently prohibit all commercial targeted broadcast TV, whereas in most other countries regulation is less restrictive.

In Southern Europe, agencies and advertisers are satisfied with current TV ad products, and to date there appears to be limited demand for new solutions. And, while an increasing number of TV sets are internet-connected, the fragmentation of hardware and TV operators presents a challenge in many markets. In smaller TV markets, such Sweden and Denmark, most industry participants find it difficult to justify a sizable investment, given the scale of potential additional revenue.

Making addressable TV advertising happen

For addressable linear TV advertising to become a reality, the TV industry will need to collaborate around new industry standards and terms, including:

- Developing a fit-for-purpose TV audience measurement system that is as auditable and trusted as traditional TV audience measurement solutions;

- Agreeing terms for how to protect, share and value consumer data between TV platforms, ad sales houses and broadcasters;

- Working with agencies and advertisers to develop case studies and proofs of concept.

To survive and thrive, the TV industry will have to invest to capitalise on new opportunities, bringing the best of digital advertising to TV. We will be discussing addressable TV advertising – and much more – in the Audiences and Advertising strand of the IBC conference.

Karin Bergvall is Senior Consultant at MTM. She is speaking during the Audiences and Advertising sessions at IBC2017 conference.

2 Readers' comments