Disney launches its own OTT service next year into a market where Netflix has spent its way to the top. Will Disney’s offer be too little too late to catch up? Or is there room for another big OTT player?

As an over-the-top (OTT) operator Netflix, with international hits like The Crown and more than 125 million subscribers in just about every country in the world apart from China, is surely now out of sight.

Is it really plausible to suggest that the big entertainment majors can catch Netflix now after helping to create a “monster” rival by putting short-term gains from library deals ahead, critics argue, of long-term strategy?

Netflix has the firepower to produce more than 700 original productions this year involving an investment of $8 billion (£6 billion).

The market is pushing the Netflix share price to new record levels and investors are demanding even more original content to protect the company’s future, despite debts and contract obligations totalling more than $20 billion.

The company has a financial fan base that attracts the sort of fairy dust sparkle usually associated with a company like - Disney.

Against such a story line surely even Disney is already too late into the OTT market with its plans to launch a full-blooded service in the US but only in autumn 2019. At the very least it will amount to a huge stretch for the Magic Kingdom.

Across the board, corporate survival of the traditional media giants could depend on the outcome of their response to the latest surge of technological disruption and the move to direct links to the consumer.

“A portfolio of well-positioned and coordinated streaming brands which includes Hulu and ESPN, could, with industrial strength content supply, present a co-ordinated threat to Netflix,” David Abraham, co-founder, Wonderhood Studios

Appearances, however, may be deceptive in one of the biggest multi-billion global plays ever seen in the entertainment business.

“I don’t think it is too late. To suggest that it would be too late would mean that Netflix remains the only source of entertainment into the future,” says Ampere Analysis research director Guy Bisson.

Instead Bisson believes that we are at the start of an explosion of streaming options reminiscent of the period just before the arrival of digital television and the rapid growth of the number of TV channels with viewers constructing their own personal, and multiple, packages.

In the US, SVOD (subscription video on demand) viewers are already taking an average of three services compared to only two in Europe.

“We are not so much at a break point but a time when all these companies are starting to look at aligning their strategy to capitalise on the opportunity of streaming. It’s not going to happen overnight and it’s not an either or for linear TV but it is going to happen in a significant way,” Bisson argues.

The future will be evolutionary but also intensely competitive, with SVOD operators vying for share in market that is expanding.

Despite the autumn 2019 launch date, with blockbusters such as Star Wars when Disney’s movie contracts with Netflix run out, the company’s gradual move into streaming has already begun.

Disney has bought the necessary technical expertise by acquiring control of streaming specialists BAM Tech in a multi-billion deal, and recently launched a sports service ESPN+ in the US following on from Disney Life in the UK.

Disney will not try to match Netflix for volume but will offer four to five original series and a similar number of movies such as Toy Story 4 and the sequels to Frozen and The Lion King.

The Disney plan is to make the new Disney streaming service and ESPN+ available directly from Disney and ESPN, from app stores and through its pay-TV partners.

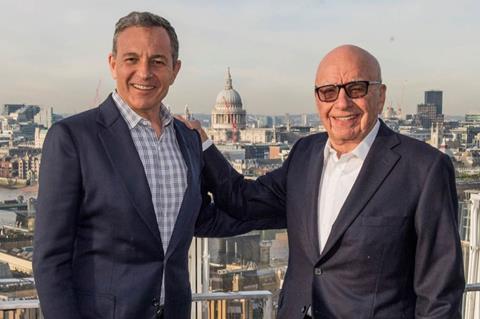

The company’s content firepower could be boosted significantly if it prevails in the battle against Comcast to buy Rupert Murdoch’s US entertainment businesses and Sky in Europe, a deal which would also come with a majority stake in Hulu and its 20 million subscribers.

Long time City media analyst Alex DeGroote believes if Disney were planning a copycat service to take Netflix on directly in the high-end drama side of the business then it would indeed be too late.

“It’s not too late if the proposition is more broad-based with sports components and movie components which Disney has in spades, something that also plays to the company’s strong relationship with the studios,” DeGroote adds.

Disney Chief Executive Bob Iger, while outlining just the sort of mixed offering that DeGroote describes, has also promised that the new Disney-only service would be priced “substantially below” that of Netflix.

David Abraham, the former Chief Executive of Channel 4 and now co-founder of a new hybrid media organisation Wonderhood Studios, is convinced of the power of Disney’s strength in depth.

“A portfolio of well-positioned and coordinated streaming brands which includes Hulu and ESPN, could, with industrial strength content supply, present a coordinated threat to Netflix,” Abraham believes.

As an example of the moving of the tectonic plates everywhere you look in the entertainment business, Abraham also raises questions about the future of HBO which could soon be changing ownership following legal clearance for AT&T’s bid for Time Warner.

“Where all that leaves HBO is less clear. In 2013 Ted Sarandos (Netflix Head of Content) said: ‘Our goal is to become HBO before HBO can become us.’ One could argue that by 2018 this has already happened,” says Abraham.

Iger, who has admitted that the disruption to the TV ecosystem has had a “faster and more profound impact than we ever expected,” is offering a service of thousands of hours of content from Disney, Pixar and Marvel as well OTT exclusives from National Geographic and other brands.

Claire Enders, founder of research group Enders Analysis, believes that the paramount OTT battlefield will be in North America and rollout launches elsewhere will come later.

As has been previously announced Disney will stop licencing content to Netflix in the US from next year.

“It’s not too late if the proposition is more broad-based with sports components and movie components which Disney has in spades, something that also plays to the company’s strong relationship with the studios,” Alex DeGroote, Media Analyst

“Disney told me they had no plans to cease licencing Netflix outside North America for the foreseeable future,” says Enders. “I asked them, ‘surely you are not planning to do one size fits all are you?’ And the answer was, ‘no we are not,’” she added.

Enders believes that the OTT innovation is essential for the saturated, cord-cutting US market but that outside the US where cord-cutting is not an issue, it is more important to protect, and grow, the pay TV business without risk of cannibalisation probably at least for another five years.

Iger has not ruled out earlier launches in some territories where rights windows allow.

Before the summer is out it should be clear whether Disney, boosted by its latest 50% cash-50% share offering for 21st Century Fox - up from a previous $52.4 billion all share offer - will emerge victorious.

Iger and Rupert Murdoch hope the new bid will trump Comcast. The two groups are also competing for the Sky group, and have essentially removed regulatory hurdles in Europe by promising to fund Sky News at the rate of £100 million a year for 15 years.

If Comcast were to stay in the bidding war Enders estimates that the US cable company would join AT&T as one of the most indebted companies in the world, something that could limit their programme and creative ambitions.

DeGroote believes that the likeliest outcome to the battle of the media giants will involve a deal with both sides getting what they most want.

“I think there will a carve-up of some sort with Disney getting the US assets including control of Hulu and Comcast getting Sky,” the analyst argues.

In the UK, DeGroote points out, people tend to overlook Sky mobile and the fact that Sky is also the third largest UK broadband operator.

Quite apart from a Sky deal giving Comcast an enormous expansion in Europe beyond it’s NBCUniversal operations, Sky’s mobile and broadband operations would mean a lot more to the cable group than it would to Disney.

In the main OTT arena in the US, DeGroote has no doubt about the importance for Disney of the outcome.

“Disney will be bolstered comprehensively if they take ownership of Fox entertainment assets in the US,” he says.

It that were to happen it would mean that the autumn 2019 Disney launch would be just in time – rather than too late.

No comments yet