The growing importance – and complexity – of VoD platforms has required vendors and service providers to provide sophisticated solutions.

The UK’s streaming market will be worth £1.25 billion in 18 months time whilst Latin America over the same period will see nearly 20 million homes subscribe to a VoD service. Everywhere we look Netflix is the dominant disruptive player, as VoD looks set to reach 200 million households within 30 months.

The commencement of VoD services can be tracked back to companies like Amsterdam’s DMC, which moved into the VoD space in 2003, predominently in support of Liberty Global.

To find out how the market is playing out for vendors and service companies, we spoke to Imagine, Telestream, DMC and Deluxe Delivery, whose president Todd Collart explains that Deluxe works directly with content owners and broadcasters to distribute content directly to consumers, to digital platforms, or via SVOD to a network of 30 distributors. It has direct relationships with more than 300 content owners.

“There are multiple ways in which they are responding to the competitive streaming market. Some are no longer licensing their content to these services as they feel they are driving down prices,” says Collart. “Some are embracing it and making these services readily available to their subscribers on their platforms, and others will openly compete with their own OTT direct to consumer service. In the US, we’re seeing the emergence of affiliate exchanges so that live local broadcast content can enhance the VOD service.

“The global video market is expanding at break-neck speed and with it, adding tremendous complexity” - Todd Collart

“Catch-up TV is essential and expected by consumers as part of daily TV viewing. Our hectic lifestyles, DVRs and binge viewing behavior created by the OTT streaming providers have un-tethered us from traditional linear programming,” he adds.

The exceptions are sporting events, news, and favoured shows or dramas. “While our clients have seen dramatic declines in TV purchases (for episodes) over the last couple of years as on-demand/catch-up TV has taken hold, this has not stopped them from offering this capability,” says Collart.

When discussing VOD services with clients, the key demand areas include customer workflow integration; metadata management; ingest once/multiple standards out; live-to-VOD streaming; plus APIs and monetization.

“The global video market is expanding at break-neck speed and with it, adding tremendous complexity,” says Collart. “On the distributor front, discussions revolve around how they can more efficiently support this demand and dynamically adapt to a rapidly changing environment, whether that be new standards, advanced formats, the next wave of devices, or a new competitor, and differentiate their services to grow share without having to make massive infrastructure investments.”

Centralised ingest alleviates the burden of managing hundreds of different sources and specs; enabling content to be ingested once and then processed and packaged to the multiple outputs required for multi-screen VOD viewing.

“We talk to content creators and rights holders about how to maximise the value of their content by expanding distribution beyond traditional PayTV channels, and reaching more global audiences,” says Collart.

From creation to delivery, Deluxe handles more UHD/HDR content than any other player in the industry - for powerful brands such as Netflix, Amazon, DirecTV, Comcast, and the Hollywood studios.

“Content availability has lagged relative to the double-digit growth in UHDTV shipments, as content owners and distributors grapple with the business model, a lack of format and device standards, investing in nascent technology that is likely to be obsolete once the market matures, and whether 4K provides a truly differentiated viewing experience,” says Collart.

This set of doubts will melt over the next year, as content creators get excited about what HDR can do for them, and consumers pick up on 4K branded content through live event broadcasts. The industry will not be able to resist challenging Netflix and Amazon, which use 4K and HDR as their point of differentiation.

“Add to this the trend to outsource the management, transformation, and delivery of advanced formats, and you now overcome the CapEx issue,” says Collart.

UK broadcaster Channel 4 has proved that mandatory registration can mean valuable VOD digital sell back to agencies.

“Data is the foundation for addressability and will be the future currency for entertainment. OTT streaming providers have a head start. They know exactly what is being consumed, by whom, and when,” says Collart. Delivery and analytics are their core competencies. Traditional distributors, broadcasters, and rights holders are definitely making investments in this area.”

There is a gap between data collection and insight. The word monetisation might change this sad fact though.

“If content owners aren’t delivering directly to consumers, they do experience a data gap because they don’t have a complete picture of viewing and purchasing behavior across the entire distribution supply chain,” says Collart.

“They have to rely on third party rating systems and monitoring services that can only capture partial and broad viewing behavior. This is why so many are testing direct-to-consumers services if they don’t already offer them,” he adds.

As with the broadcast industry vendor trend of consolidation, can content owners keep to the pace by Netflix?

“Consolidation is inevitable. There are few, if any, discrete OTT/SVOD services generating meaningful profits. There is only so much premium content and the cost of that content represents a huge expense that is eroding already thin video margins,” says Collart.

“The current market leaders have already garnered significant share so new entrants are jockeying for position in an already crowded space.

“Original content is a key point of differentiation but once the series is over, a VOD service still needs to have a rich catalog or niche content and a high-quality experience to retain viewers,” he adds.

DMC Director of Business Development Jean-Louis Lods explains that DMC is now on board with over 100 platforms.

He says: “Every platform critically has its own bespoke requirements – the metadata, the poster formats, the sizing, through to the file requirements. Some platforms want full resolution mezzanine files. For the majority we do the transcoding and output, and the APR file or the transport stream file.

“It makes a huge amount of sense for our clients (110+ play out channels) to use our services for on demand because we already have the assets plus all the versioning components. We have multi-lingual files, subtitles and audio for a lot of territories, so those companies don’t need to double down on media asset management,” he adds.

Europe is somewhat different to the USA.

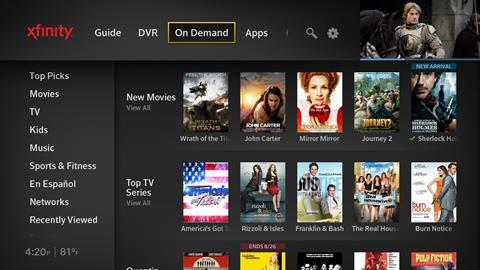

“The Americans have the Cable Labs standard, and the metadata schemer and formats of the files distributed are pretty much the same. But in Europe every operator, whether that be in OTT, cable or IPTV, has their own unique specs,” says Lods.

“We have spent a lot of energy in making sure that we have a highly automated workflow to deliver to all the different platforms,” he adds.

Dynamic ad insertion and viewer data extraction are both big deals.

“On classical VOD for cable and IPTV we have supported for some time pre-roll and post-roll ad insertion, and what we see now is a move towards dynamic ad insertion, and that is supported a lot more in the OTT space. That’s a certain area we want to pursue.”

Quite a lot of operations are trying to get their head round how dynamic ad insertion can work properly.

“A lot of the broadcasters are still trying to work out what the business model is behind SVOD or VOD services,” says Lods.

Discussing the potential of dynamic ad insertion for traditional broadcasters, Lods says it is still early days and that broadcasters are coming to terms with the notion of DAI as a revenue building solution.

“Typically they are required to deliver a certain amount of on demand material in support of their carriage agreement, but how do they monetise this? When you look at Netflix and its subscriber base the margin is very small.”

George Boath, VP of International Sales, explains that Telestream offers the Vantage family solution VOD Producer and the Lightspeed Live for supporting users in a fast changing market with management and automation tools.

“VOD producer is specifically targeted to help people prepare content for different platforms, considering requirements such as the Cable Labs spec and the different technology standards they have to comply with,” he says.

“We are also doing a lot of work to help them prepare content for dynamic ad insertion in VOD services. People are looking to condition advertising so they can deliver different spots either pre-roll, mid-roll, or post-roll.

”The Telestream role is not in inserting the ads or managing the payload, it is about grooming and conditioning the asset.

“The source of what we call VOD is changing a lot,” says Boath.

“More conventionally it is prepare a major asset like a movie or high value series, something that is prepared in advance. But increasingly it is a time-shifted program that went live to air - a live studio show, a live sports event, or live discussion. People want to turn that into a VOD asset.”

With the Lightspeed Live, users can capture that live feed for either editing or streaming. VOD preparation can remove unsuitable ads or promos.

“VOD is still predominantly IPTV but it is becoming OTT as well as people want to watch on mobile devices. Our users when they prepare an asset that could go to VOD are having to prepare a surprisingly different number of versions,” says Boath.

To support this he pointed to an ITV stat of typically making 22 versions to deliver to 15 different VOD platforms. The whole process is intensively complicated, so customising management tools are crucial.

“There are people who have complex needs but quite small volume, and people who have complex needs and really high volume. We scale both ways, sad Boath.

“The programmatic thinking is very different because people that watch on the move have shorter attention spans. Content owners tend to create very short pieces.

“The traditional sponsorship model of a 30-second ad in pre-roll does not work because consumers just switch off. So the sponsorship is more in the middle of the piece,” he adds. “It does not impact on our technology but it makes it relatively easy for someone to make those versions and package them differently as long as someone makes the editorial and creative decisions and sets the rules.”

With regard to new technologies impacting on the VoD space, Boath picked UHD, the strong demand for HDR, and VR.

“Everybody we speak to wants to know if our technology will support a VR channel. We see a lot of people wanting to produce with HDR, and a lot more wanting to produce more channels of audio for better surround sound. And they are all checking if there is a mass market application for VR,” he says.

Did broadcasters rush into VOD and OTT without realising they were rushing into an OPEX future?

“A lot of them went into OTT partly as a defensive mechanism. They felt they had to be in this space,” says Boath. “A lot of OTT offerings were designed as brand loyalty or marketing exercises to drive people to the mainstream channel, but now they have discovered ways of generating and designing ad campaigns and making some revenue from OTT they are revenue providers in their own right.”

One big thing coming up is the desire to monitor and control the quality of service to new audiences on the Internet. This was one good reason why Telestream bought IneoQuest, a specialist in video quality monitoring and analysis.

Like Telestream, Imagine offers elements of the VoD processing chain.

CTO Yuval Fisher was quick to assert “we don’t have the middleware. If you are a service provider you still need subscriber management and content management middleware.”

Of course Imagine has a preferred partner here, and that is Siemens. So what did Fisher want to front up with?

“We have a video processing workflow. VOD video processing involves not just transcoding but also QC and potentially other kinds of specific processing, that you need on VOD subtitles maybe,” he says.

The Imagine focus on VOD preparation involves the Zenium workflow engine. Fisher wanted to focus next on monetisation potential.

“We have a broad and strong ad insertion and ad management capability. The management is about how you sell ads, manage the various rights issues associated, and manage the campaigns. Insertion is about how you execute the posting of ads into the asset,” he says.

“We also have the core technology to hoist and emit or deliver the VOD so we created the idea of Just-in Time (JITP) packaging, the notion that you could store a mezzanine version of an asset and deliver that in multiple formats to multiple devices that consume different formats,” he adds. “You do not want to take all your assets and store them in every format.”

This where the Telurio Packager JITP comes into play in terms of the mezzanine format, so Imagine is into video processing, monetisation and delivery aspect.

“We are just emerging with technology offerings,” says Fisher. “We don’t have today for example a turnkey cloud-based service where you can come with your VOD library and you have a VOD service. We enable the core back end technology but we are not a complete offering yet.”

On the matter of broadcasters rushing into OTT and aborting the CAPEX business model, Fisher says: “There has definitely been a shift to OPEX but we are closer to the beginning of it than the end. There is still a lot of CAPEX pricing on all these VOD components, but the move to cloud and the move to Sass has moved the money. Revenue comes from the IP side of the house. Today OPEX is coveted because the recurring revenue has more value than a fixed sales amount.”

On the issue of new technologies, Fisher went with the move away from elements such as hardware acceleration. “Finally we have reached the stage where you can do all your processing in software. That enables a generic cloud. And it gives us the creation of a complete end-to-end video processing chain. Users want software solutions, and that is part of the enablement of moving to OPEX pricing.”

No comments yet