Tesla and SpaceX founder Elon Musk and Amazon boss Jeff Bezos have launched their own rocket companies as they seek to tap into the planet’s ever-increasing demand for broadband connectivity. Chris Forrester assesses their chances.

Way back in 1957, Russia launched Sputnik-1, the world’s very first satellite. The first communications satellite came a few years later with Telstar-1 in 1962 and which provided the first-ever TV signals across the Atlantic. Since then mankind has placed around 8400 satellites into some sort of orbit, of which more than half are inactive.

This includes all manner of craft, including meteorological and scientific satellites, so-called ‘spy’ satellites and about 140 satellites for GPS use in vehicles.

However, according to the United Nations Office for Outer Space Affairs (UNOOSA), only a small proportion of the launched total are still orbiting in geostationary orbit at 36,000 kms/22,000 miles high and supplying communications. A handful of them provide broadband communications for users.

All that looks likely to change, starting in May when Elon Musk, he of the SpaceX Falcon rockets, Hyperloop, Tesla electric cars and The Boring Company, launches his first batch of some 12,000 ‘Starlink’ satellites. He launched two test craft in February 2018 (cheekily called Tintin 1 and 2), and Musk’s plan is to have 2200 satellites in Low Earth orbit (LEO) within the next 5 years.

Musk’s SpaceX president Gwynn Shotwell, interviewed by the Wall Street Journal in April said: “I’m pretty sure we can launch satellites into orbit.” One question SpaceX is still asking itself, she said, is “can you make money out of it?”

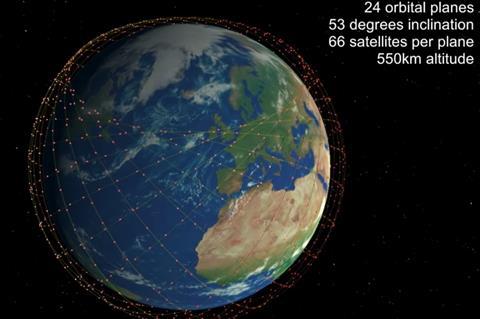

The Federal Communications Commission (FCC) approved Musk’s overall launch plans at the end of April by permitting the ‘Starlink’ fleet to start deploying at just 550 kms high, and promising ultra-fast communications to antennas on the ground.

Shotwell, on April 26th, said: “This approval underscores the FCC’s confidence in SpaceX’s plans to deploy its next-generation satellite constellation and connect people around the world with reliable and affordable broadband service. Starlink production is well underway, and the first group of satellites have already arrived at the launch site for processing.”

The rest of Musk’s plans will see satellites orbiting at various LEO heights up to 1325 kms.

But Musk is far from alone in seeking to tap into the planet’s ever-increasing demand for broadband connectivity. Amazon’s billionaire founder Jeff Bezos is also on the case. And just like Musk he also has a rocket company to help with his ambitions to having a mega-constellation of satellites in service by 2024.

Bezos will use his ‘Blue Origin’ rockets to launch over time 3236 satellites into LEO and provide internet to “unserved and underserved communities around the world.” Bezos has dubbed his system Project Kuiper, and it is Kuiper Systems that has applied to the International Telecommunications Union (ITU) to help coordinate frequencies and orbits which will operate from 56 degrees North (about level with Scotland) to 56 degrees South (just below the southern tip of South America and thus cover more than 95 percent of the planet’s population.

Amazon says of the plan: “Project Kuiper is a new initiative to launch a constellation of LEO satellites that will provide low-latency, high-speed broadband connectivity to unserved and underserved communities around the world. This is a long-term project that envisions serving tens of millions of people who lack basic access to broadband internet.”

Bezos has a considerable advantage over Musk, and other would-be suppliers of satellite capacity. Amazon already has a relationship with millions of clients, whether to its parcel-delivery services or Amazon Prime video-to-music OTT services. He also has a considerable cash war chest – notwithstanding his recent divorce – to fund initial investments and probable losses.

“That makes me wonder quite how much financial pressure SpaceX is now under” Tim Farrar, TMF Associates

Musk does not have that financial safety net. Indeed, in April it emerged that Musk was seeking another $500 million in funding. According to a regulatory filing, Musk’s Space Exploration Technologies is the cash-raising vehicle, and the money will go to ‘Starlink’. Musk tried to raise a similar sum a few months ago, and the fresh cash-raising suggests that investment in the project is being ramped up, perhaps because of the threat from Bezos – and others.

Tim Farrar, a well-respected analyst from TMF Associates, wondered in April whether Musk can manage to fund his SpaceX rockets, Tesla cars, Mars mission and Starlink operation. Farrar says that an individual antenna to pick up and connect to Starlink’s satellites will initially cost a worrying $500 each, although could fall to nearer $150 over time and as production volumes increase. This is not a small investment for users but if that user is living in a ‘no reception’ area then funding an antenna would be a welcome penalty for high-quality broadband access.

Farrar also quotes from a Wall Street Journal report which states that Musk’s financial team only managed to raise $44 million out of an earlier $400 million cash raising exercise. Farrar says: “That makes me wonder quite how much financial pressure SpaceX is now under”

And there are also plenty of other schemes to be considered. Top of that list includes the likes of entrepreneur Greg Wyler – and backed by Japan’s massive Softbank, Intelsat, Virgin and even Coca-Cola – and who also wants his OneWeb satellite service to supply bandwidth to the unconnected. OneWeb promises to start commercial services as early as 2021.

OneWeb’s CEO Adrian Steckel, speaking in April says that the first important stage is to start launching batches of LEO satellites at a rate of 35 a month, every month, from this coming December.

OneWeb, in partnership with Airbus, is now building those satellites at a rate of at least one a day at a new purpose-built factory in Florida. The launch rate will continue until there are 650 satellites in orbit. It will take 20 launches to achieve that target.

Steckel added that these LEO-based satellite services would be complementary to fibre and other ground-based delivery technologies. “And we’re all about broadening the use case of satellites. We see a future where you have flat panel antennas in a car, on a train, on a plane and on a boat that are inexpensive and allow you to get quality broadband at speed.”

- Read more: OneWeb secures $1.25bn in new funding

OneWeb’s broadband capacity target is to supply one Terabit/second in total to consumers initially. As extra satellites are lifted into space that overall throughput would jump ten-fold or more.

But besides Bezos, Musk and OneWeb there are other established satellite players including Canada’s Telesat, Singapore’s Kacific, LeoSat, Kepler and SES-backed O3b looking to supply bandwidth into this ever-hungry market. Paris-based Eutelsat is also looking at developing a LEO constellation.

The world has come a long way since Sputnik but between them these new players plan on launching around 20,000 satellites, and mostly for broadband to consumers. That’s massive progress.

No comments yet