As sports return to our screens, analysts are predicting a downturn in the sports broadcast rights market. But what will be the longer-term impact? Ross Biddiscombe investigates.

With the first major sports rights deal in the Covid-19 period announced last week, the German Bundesliga has been left with a $200 million shortfall and predictions for a softer market in the future are now coming in thick and fast.

The Bundesliga was the first major football league in the world to return to TV screens following the live sports lockdown period that began in March, so its latest rights agreement was more eagerly awaited than usual and suddenly not just because analysts felt the league had been previously undersold.

- Read more: Live sports return to our screens

The German league will receive a total of $4.4 billion from pay TV operator Sky Deutschland and OTT service DAZN for four seasons of domestic live coverage starting in 2021. Not only was that less than expected, it was a double negative given that the previous four-year deal landed $4.6 billion for the league which was touted as an 85% increase.

Richard Broughton, research director at Ampere Analysis, was originally anticipating an increase in rights value for one of Europe’s top four football leagues because the economics of their local TV market pointed that way. “Before the auction, the Bundesliga was underperforming its peer group of competitions in domestic rights revenue, relative to the size of the home audience and the willingness to pay of the fanbase. Secondly, Sky had grown its revenue base in Germany over the last rights cycle, and we weren’t seeing the same levels of cord cutting there as in many other developed markets.”

But the lack of competition proved to be the biggest factor in the surprise shortfall, according to Broughton, who noted that the German marketplace had already been hit by the withdrawal earlier this month of Discovery-owned Eurosport as a bidder as well as no interest from either Amazon or Deutsche Telekom. “This is where the downward pressure has played in. DAZN isn’t in the strongest of positions - it can’t justify overspending for securing a very long-term position in the market. It left Sky with the ability to place a relatively low bid and still win the bulk of games,” he said.

Now, the pandemic is also a growing factor in sports rights negotiations as leagues are being pushed even further to meet the funding gap, according to a report published this month by Enders Analysis. “The Covid-19 crisis is compounding the already grim revenue prospects for upcoming football rights sales in continental Europe,” it stated.

Co-authors of the report François Godard and Jamie McGowan Stuart believe Europe’s financially weakest leagues among the top five, especially Serie A in Italy, are now in a weaker position in negotiations with broadcasters. The Italian league - whose next rights deal starts in 2021 - has been looking to private equity firms and even received an offer from Luxembourg-based CVC Capital Partner in May.

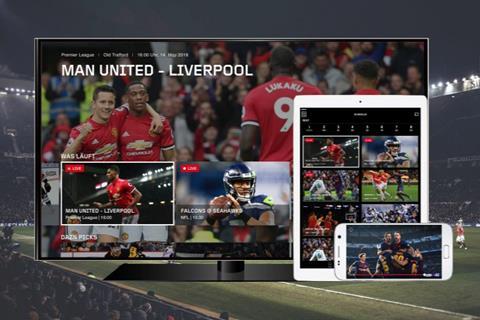

Sports consultant, Stephen Nuttall, pointed out sports rights holders will need to be aware that the more diversified broadcasters – such as Sky Sports and BT Sport in the UK that combine sports channel subscriptions with telephony and broadband – will perform better through any economic downturn and will be best placed for future auctions.

“The economic climate brought about by the pandemic will focus the broadcasters as to who merits a rights fee and who doesn’t,” he said. “And middle to lower end sports and events will be squeezed harder.”

Nuttall said some rights holders might be forced to look at direct-to-consumer options as well as private equity which means that both sports organisations and broadcasters will have to be open to new money.

The rebate debate

At least the broadcasters and most major sports rights holders are not fighting to the death over rebates. For example, UK broadcast partner Sky Sports allowed EPL clubs to defer the payment of more than of $213.2 million until the 2021/22 season and, according to media reports, the UK’s other major pay TV broadcaster BT Sport and EPL’s international broadcasting partners will eventually receive a minimum collective rebate reportedly worth almost double that amount ($413.8 million). The fact that churn rates have only risen slightly during the pandemic has helped both sides in the rebate negotiation.

Meanwhile, DAZN - the global OTT service probably affected most by the crisis because its subscribers can cancel at any time - has now bet heavily on the German market because it will be that country’s main supplier of Champions League TV starting next year. Over $1 billion in losses over the last two years may be starting to hurt DAZN and it is unclear how strongly the OTT platform will bid for major rights after the Covid-19 lockdown is fully in the past. It has already touted itself to new investors with as much as $500 million on the price tag for a share of the company.

Although the market is likely to flatten in the future, some forecasters believe DAZN and all other broadcasters can at least enjoy a less volatile marketplace. Julian Aquilina, senior analyst at Enders Analysis predicts that there will be no dramatic changes to the sports rights landscape in the medium term, although the top European football leagues are facing pressure on their domestic TV rights sales. “The current pandemic puts extra pressure on rights fees, because sports broadcasters have taken a financial hit with the recent freeze.

“TV audiences for the first matches back have been very high as a result of pent up demand, but this will soon calm down if we continue to return to normal,” said Aquilina, “and, in a year’s time, there probably won’t be much advantage for broadcasters or rights holders.

“The next English Premier League auction is still many months away, but we weren’t expecting significant inflation for the domestic TV rights even before the pandemic. Most likely, Sky and BT will be more disciplined for domestic rights, while international growth will continue,” he said.

Richard Broughton agrees that the fundamentals of the sports rights market may be temporarily affected, but not for long. The huge pots of money spent on football rights, for example, are unlikely next time around, especially as the buying models for the likes of Amazon and the other FAANGs will stay the same – they will remain opportunistic because the cost of a large number of games, for instance, in for the EPL’s domestic market still do not make clear economic sense.

For Broughton, the Bundesliga deal this week highlighted the challenges with monetising rights. “You need a strong multi-genre business to support the top fees, and there are only a few companies in each market with the ability to do this. If one or more reassess strategy, it leaves the remaining bidder or bidders in a stronger position,” he said.

No comments yet