The demand shock of Covid-19 continues to reverberate, but many technology suppliers see investing in R&D as the only way to fight back.

As the IABM’s most recent report put it, the pandemic has dropped a “digital bombshell” on the media industry. Most companies have had to bite the bullet to defend their positions and accelerate their move to software, IP and virtualised products accompanied by as-a-service business models.

The impact is clear in the recent financial results of one of the industry’s stalwart engineers, Evertz. Its revenues for Q1 (May 1, 2020 – July 31, 2020) were down 46% versus the same period 2019. Trading in the US was especially challenged, with Evertz recording a 51% decline in revenues in the region.

- Discover other industry innovations at the IBC Showcase

- Understand the latest tech trends with IBC365 Webinars

- Learn more about the benefits of exhibiting at IBC2021

It’s a pattern being repeated – at least in those companies making public financial reports. Analyst Devoncroft estimates Grass Valley’s Q1 2020 revenue was down 41%; Avid and Harmonic also highlighted that their legacy products had suffered from a more pronounced decline in revenues, as reported by the IABM.

IABM analysis shows that the pandemic has negatively influenced both software and hardware revenues on aggregate, as media technology budgets have generally declined. However, companies heavily reliant on hardware and legacy software have been impacted disproportionately more by the lockdown restrictions.

Mo Goyal, senior director for international business development at Evertz, says: “A number of projects we were in discussions with at the beginning of the year were put on hold. After the initial urgency of pulling together solutions with operators working from home, the focus now is on the reality of having some team members in the facility and others working remotely. There’s been an acceleration of the shift to cloud services and those companies who were part of the IP transition found it easier.”

Nonetheless, according to a Devoncroft study, Evertz was able to grow its R&D spend in the face of a 46% decline in revenue. The Canadian government’s wage furlough scheme enabled the Ontario-based company to actually increase headcount in its R&D wing.

“We are proud of continuing to invest in R&D,” says Goyal. “Early on in the pandemic we reached out to a number of key customers and asked them what their new challenges were. That helped us prioritise programs that we had been working on deploying, such as the DreamCatcher live production suite in the cloud. It was always on the roadmap, but it got accelerated. We have less focus on other technology because the shift means we have to get into more of a software mode, which was not in our roadmap at the beginning.”

“Any reduction in R&D will inevitably result in delayed deployments of exactly the sorts of technologies that would help broadcasters do what they more urgently need to do,” Ciaran Doran, Rohde & Schwarz

Sydney Lovely, CTO and general manager for networking at Grass Valley, declined to confirm Devoncroft’s estimate but comments: “We were in a period of transition and our business operation were very stable, but had we been 100% in or out of Belden we may have made more dramatic changes.”

As the industry moves to remote productions for live events and remote collaboration for postproduction, many traditional suppliers are sitting on old technology stacks, many hardware based, and cannot pivot that quickly.

Graham Sharp, CEO of Broadcast Pix, says: “Faced with declining revenue streams from traditional products, many companies have no choice but to cut costs. They are faced with the innovator’s dilemma: they must support their traditional products, maybe modifying them somewhat for the current environment to keep sales flowing, leaving no resources available to create new technology and products. Rather than adding more R&D resource, they are reducing it on the back of declining sales.

“Meanwhile, with open source technology, it is relatively easy for a start-up, or small agile company to quickly and easily create innovative software-based products that serve the new world we live in.”

- Read more: The metaverse is coming

Roadmap revision

All twelve vendors replying to IBC365 for this article said that Covid-19 had barely impacted their business and/or that internal R&D was unaffected by the crisis. Of course, these respondents are understandably keen to promote their foresight in being ahead of the market when it comes to having product primed for softwarisation.

“Early on in the pandemic we reached out to a number of key customers and asked them what their new challenges were. That helped us prioritise programs,” Mo Goyal, Evertz

Adam Leah, creative director at nxtedition says: “There has been no need to adjust our development roadmap or change our product as it was designed to work within the new requirements of broadcasters during this crisis. As a company everything we do is microservices, web technology and virtualisation.”

While 44% of suppliers replying to the IABM’s recent census indicated their R&D would increase under the pandemic, that leaves a question mark over the rest.

Henry Goodman, director of product development at Calrec, says: “More than ever, this is the time for manufacturers to work collaboratively, and any reductions in R&D across the industry will slow everyone down.”

If not diverting extra cash into R&D, media technology suppliers are increasingly focused on speeding up the development of new products and platforms. Many vendors told the IABM that they have developed new products in a drastically shorter amount of time and on the back of pressing customer feedback.

Telestream accelerated the debut of GLIM, which allows customers to play mezzanine and professional-grade media files over the internet in a browser; Broadcast Pix switched all development from its planned roadmap to creating StreamingPix which is the firm’s first streaming focused appliance. It is looking to hire more software engineers as a result. R&D spend has “gone up slightly” at Cinegy, according to Jan Weigner, company president and CTO, to deal with additional customer feature requests resulting from an increased remote and cloud focus and to bring roadmap features forward faster.

Sony’s Smart Production solution, developed and trialled by Sony R&D teams in Basingstoke with German public broadcaster SWR, was a direct consequence of SWR’s need to find a new way of producing content with a reduced crew.

John Stone, head of European professional engineering (EPE) at Sony, says: “In parallel, the timetable of some solutions, like our automated production tool with Norwegian broadcaster NRK [currently codenamed Metadata Wrangler], was not negatively impacted by Covid-19, as it was deployed as a cloud service.”

Nor has MAM vendor Tedial witnessed any Covid-19 impact on its R&D. “Our tools have been hosted in the cloud for many years,” says CTO Julian Fernandez-Campon. “What we’ve done is reinforce remote production in the cloud and the use of cloud media services and hybrid cloud.”

Daniel Lundstedt, sales and marketing at Intinor, says: “We’ve been very fortunate that even though some projects were delayed, and sports productions impacted, others fell into our lap. Our roadmap is created in close dialogue with our customers and due to COVID-19, both we and our customers have had more time for testing and planning.”

Ciaran Doran, director of marketing, broadcast & media, Rohde & Schwarz, adds: “If anything, the crisis has encouraged us to speed up in the direction that we already set – software-defined platforms from studio production to playout, that are modular and configurable for the specific workflows required.”

Grass Valley always earmarked April to launch its cloud-based Agile Media Processing Platform, but when the pandemic happened it changed a limited release into a more fully featured one.

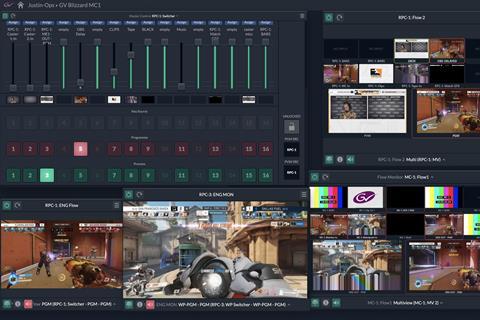

“We’d developed the initial application with Blizzard Entertainment but when they were shut down we pivoted our team to expand the solution from remote production to a fully decentralised one in which they could take feeds in from all around the world and produce and publish content using just a browser,” says Sydney Lovely. “Since then, our IP product lines have taken off like a rocket ship.”

IP and SaaS warnings

The crisis is widely understood to have forced the hands of media organisations and tech suppliers into accelerating direct to consumer offers and the cloud-based infrastructure to support it.

“The broadcast industry is at a critical point with IP deployment starting to gain momentum,” says Goodman.

Yet the crisis is in danger of knocking that off course. “We were surprised by a resurgence of interest in SDI,” says Goyal. “Companies are planning to make their next big investment in the transition to IP but the pandemic has put those investment dollars on hold. So, there’s an element of thinking ‘what can I get away with incrementally without having to do a complete overhaul whilst still being on an IP path long term’.”

Grass Valley, which still chairs the Alliance for IP Media Solutions (AIMS) it co-launched in 2015, concurs. “We’re seeing more hybrid approaches than green field sites,” says Lovely. “For some [clients] in the lower end of the market SDI is good enough and sticking with that. The upper quartile is all in for IP. It’s the middle sector who know they want to get to IP but can’t afford to get there where we are seeing some incremental SDI purchases.”

The business continuity crisis has also accelerated media companies’ transition to as-a-service technology models.

According to IABM, the transition has well-known financial implications for the supply side of the industry as companies moving from large and infrequent inflows of money to smaller and more regular payments, suffer from a painful and lengthy cashflow crunch. IABM research shows that this crunch has been exacerbated by the pandemic-induced shock on technology demand by forcing a move to subscriptions and on-demand billing.

Simon Browne, VP product management at Clear-Com, says: “There is certainly a great deal of interest in looking for as-a-service solutions from vendors, but these soft products are far from easily managed. It requires a fully formed back office and maintenance methodology to be successful. Our own customer experience tells us that only a few customers are ready to handle the licenses and repetition of payments that fall out of this service approach.”

“Managing this transition has its perils and very few suppliers in our industry have done it,” warns Sharp. “You have to cross the revenue ‘valley of death’ – convert permanent license orders to annual licences at 20% or 25% of the value. The business must be extremely well-funded to cross this chasm and I am not sure many in our industry are.”

Trade show absence

The loss of trade shows is also impacting the decades old R&D cycle. NAB and IBC forced development to hit a date. The IABM thinks their calendar absence has prompted suppliers to move to a more continuous delivery of technology solutions.

David Ross, chairman and CEO, Ross Video, agrees. “If you let dates slide to the natural point where R&D wants to have it, you may release [product] much later than you [predicted]. So, I think it might slow down the pace of our industry but decrease the vapourware at the same time.”

“Many companies have no choice but to cut costs. They are faced with the innovator’s dilemma: they must support their traditional products…leaving no resources available to create new technology and products,” Graham Sharp, Broadcast Pix

Weigner believes there’s no excuse not to plough the savings made by not marketing or exhibiting at trade shows into R&D. “The moment you cut down on R&D you have a problem which is not as easily solved as reduced tradeshow, marketing and other ongoing costs. As most tradeshows have been cancelled this should provide ample savings to make R&D cost reductions implausible – unless you really do not believe you have the right product or approach anymore.”

Lovely believes the usefulness of trade shows as a marker for new product deadlines is outdated. “Instead of big bang hardware-oriented releases you are seeing these turn into software,” he says. “Companies like us are working more in collaboration with customers who are interested in seeing updates more frequently rather than having to wait for an upgrade.”

Not all will survive

If the health of a market can be measured by total R&D spend “any reduction in overall R&D would therefore show some stagnation and put innovation and end customer experience on hold,” says Browne.

Business continuity has become a key priority for media companies. “The requirement to connect creative teams with production tools, irrespective of location, has grown significantly over the past six months,” says Sony’s John Stone. “The transition to systems based on cloud, virtualisation, IP, remote production and subscription-based service models has accelerated, and these technologies are now featured within the overall product/solution/service portfolios from leading suppliers.”

Be that as it may, if a company is jumping onto that bandwagon only now, there is a lot of catching up to do, though Weigner says this depends a lot on what it is that you do: “Are you digging for gold yourself, getting paid for digging, or selling the shovels, or now - as a new business - providing the latest shovels right to the customers’ site, whenever needed, billed conveniently by the hour?”

Compared to other, perhaps younger industries such as IT, broadcast is immature with a fragmented ecosystem composed of lots of little players.

“Take multiviewers as one example,” says Lovely. “There are fifty companies making them. As an industry we are investing a lot of R&D in duplicate efforts. That’s not going to make sense in the long term. We need to focus spend on more specific functions. The industry was already on that path but COVID has accelerated it. The businesses that will win are those that are able to achieve that and drive efficiency… but there will be a shake-out of some who are less fit.”

Doran agrees. “Any reduction in R&D across the industry will inevitably result in delayed deployments of exactly the sorts of technologies that would help broadcasters do what they more urgently need to do, which is to serve content differently to consumers who have also changed their consumption behaviour as a result of the crisis.

“Not all companies will survive the pandemic,” he adds. “Some will face challenges that force short-term thinking at a time when broadcasters need rock solid partners who can serve them when, eventually, the recovery happens.”

The IBC Exhibition provides the perfect platform to network and build relationships with suppliers and customers. Find out more about the benefits of exhibiting at IBC2021.

No comments yet