Households with children are less likely to cancel streaming service subscriptions than those without them, according to new research from Ampere Analysis.

As a result, streamers are scooping up kids’ titles to appease the influential kids audience in a bid to retain subscribers and to reduce churn.

However, children and family titles have been among the most affected by the global slowdown in commissioning experienced between 2022 and 2023. The number of children and family TV titles announced during that time fell by 15% globally.

VoD original children’s TV titles decreased by 18% between 2022 and 2023, but well-funded public broadcasters have provided more consistent opportunities for the creation of children’s content, especially in Western Europe.

Given the reduction in original children’s content in the market, Ampere concluded that those who can fund their own new children’s titles will have an advantage in a busy acquisition market.

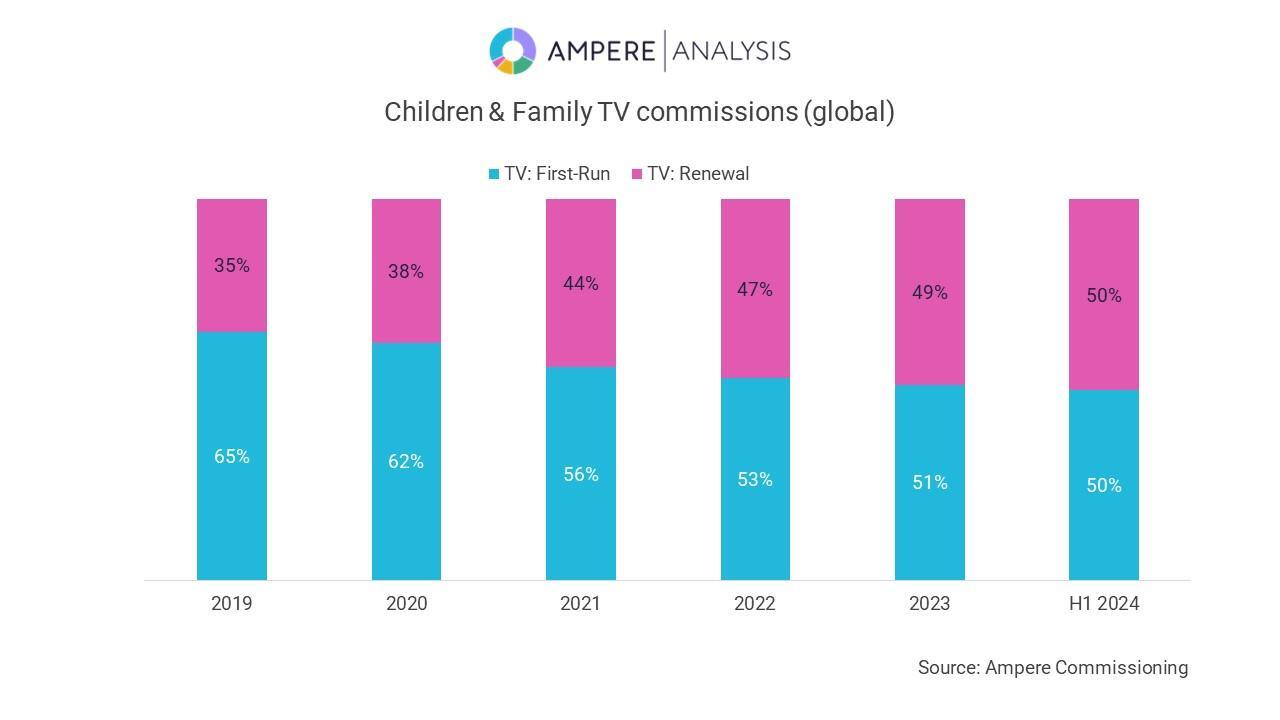

Ampere said that children’s content based on existing ideas has also proven to be more robust during the global slowdown. Children’s book adaptations fell by just 9% between 2022 and 2023 versus a 15% decline in all global children’s TV content over the same period. Half of all children’s titles announced in the first half of 2024 were renewals.

Olivia Deane, Research Manager at Ampere Analysis said: “A global decline in commissioning caused by slowed growth in the streaming market poses a range of challenges to children’s content. Children & Family titles were the third most affected by this slowdown between 2022 and 2023. They were behind only the more expensive genres of Drama and Crime & Thriller. Those who can find independent funding, especially for titles based on existing intellectual property with reliable audience appeal, will have an advantage in a busy acquisitions market.”

You are not signed in

Only registered users can comment on this article.

John Gore Studios acquires AI production specialist Deep Fusion

UK-based film and TV group John Gore Studios has acquired AI specialist production company Deep Fusion Films.

Sky to offer Netflix, Disney+, HBO Max, and Hayu in one subscription

Sky has announced "world-first" plans to bring together several leading streaming platforms as part a single TV subscription package.

Creative UK names Emily Cloke as Chief Executive

Creative UK has appointed former diplomat Emily Cloke as its new Chief Executive.

Rise launches Elevate programme for broadcast leaders

Rise has launched the Elevate programme, a six-week leadership course designed to fast-track the careers of mid-level women working across broadcast media technology.

Andrew Llinares to step down as Fremantle’s Director of Global Entertainment

Andrew Llinares is to step down this spring from his position as Director of Global Entertainment at global producer and distributor Fremantle.