Just 5% of US internet households have only a pay-TV service, according to new research from Parks Associates that indicates how legacy pay-TV companies are continuing to lose subscribers to streaming video services.

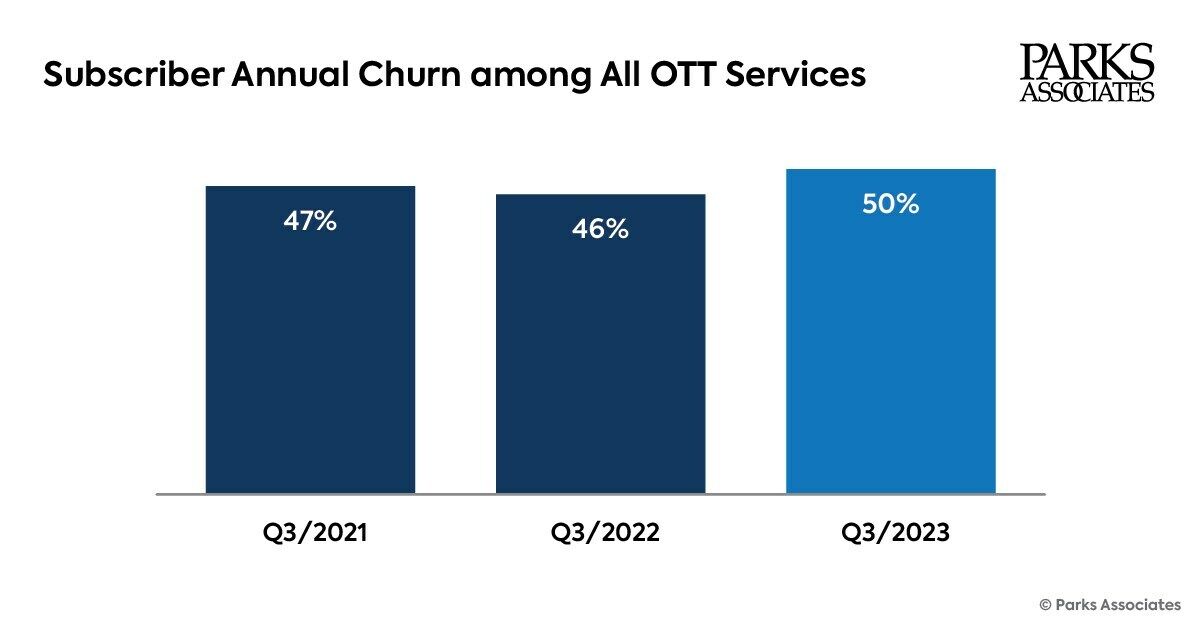

However, the average annualised industry churn rate for streaming services is 50%, meaning many streaming services are also struggling to keep their customers.

“Sixty-five percent of internet households have a smart TV,” said Eric Sorensen, Director, Streaming Video Tracker, Parks Associates.

“This platform interface serves as the entry point for many households to their content services. Competition for attention is extreme, while the continued rollout of the ATSC 3.0 standard gives viewers even more options, so in 2024, we will see increased consolidation, mergers, and acquisitions as all providers must find ways to innovate alongside the greater emphasis on profitability.”

Parks Associates said traditional telcos are exploring new ways to get their products in front of streaming consumers with services such as Cox’s Neighborhood TV. Cox is positioning this hyperlocal streaming service to expand its influences in its communities and as a gateway to attract consumers to its phone, internet, and TV bundle. Station groups such as Sinclair and Hearst have also launched local streaming services to leverage the consumer desire for local content in the age of streaming.

“The hyperlocal approach clearly attracts interest from consumers,” Sorensen said. “With the increase of AVOD business models, consumer adoption indicates that relevance is a key factor, namely consumers are likely to turn off services if the service and messaging are repetitive and irrelevant to them. Even manufacturers recognise the need for personalisation – for example, LG will be displaying its MyView smart monitors at CES2024, which the company designed to deliver a personalised experience to the user.”

You are not signed in

Only registered users can comment on this article.

WBD mails definitive proxy statement to finalise Netflix merger

Warner Bros. Discovery (WBD) will hold a special meeting of shareholders to vote on the merger with Netflix on March 20, 2026. In the meantime, WBD has begun mailing the definitive proxy statement to shareholders for the meeting.

Sky's talks to acquire ITV slow down

Talks by Sky to acquire ITV’s broadcast channels and streaming platform have slowed in recent weeks, according to a report by Reuters.

Bytedance pledges to rein in Seedance AI tool

Chinese technology giant ByteDance has pledged to curb its controversial artificial intelligence (AI) video-making tool Seedance, following complaints from major studios and streamers.

Digital switch-off prospect nullifies Arqiva’s value

Arqiva’s main shareholder has admitted that its holding of the transmission company might be worth nothing.

Warner Bros Discovery mulls re-opening sales talks with Paramount

Warner Bros Discovery is considering reopening sale talks with Paramount Skydance Corp, according to a Bloomberg report.