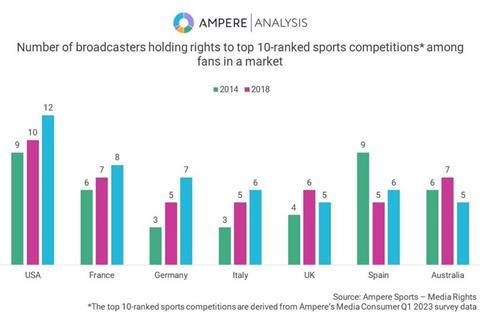

Broadcast rights to popular sports competitions are increasingly being split across a growing number of services in major Western markets, according to research from Ampere Analysis.

Changing viewing habits are driving the proliferation of streaming services that are turning to live sports coverage to boost engagement and subscriptions. In turn, rightsholders are seeking ways to exploit this rise in potential buyers for the purpose of growing media rights revenues.

This has proved successful, according to Ampere figures. Total annual media rights spend in the US, UK, France, Germany, Spain, Italy, and Australia grew from $20.8bn to $34.9bn between 2014 and 2022, an increase of 68%.

Reducing financial burden by sharing investment in rights to sports properties with other broadcasters is one positive result of the fragmentation in the media market, said Ampere. This is the case for both incumbent TV players who are facing growing financial pressures and the new streaming entrants who are striving towards profitability and looking to slow their spending on content.

Read more Grass Valley appoints new COO

Currently, sports fans take an average of 3.3 paid streaming services per household, versus an average of 3.1 for the average Internet user. This figure is still rising – suggesting fans may be accepting of this increasingly fragmented media market for now.

Germany illustrates the fragmentation trend clearly, said Ampere. Here, the number of broadcasters with the rights to the top 10 sports competitions has been consistently growing. In 2014 a trio of operators owned the rights; by 2022 that had more than doubled to seven. While Sky Deutschland has maintained its position as the market leader, its share of rights spend across the top 10 competitions has fallen from 62% in 2014 to 40% in 2022. Streaming service DAZN’s share has more than trebled from 7% in 2018 to 26% in 2022.

Daniel Harraghy, Senior Analyst at Ampere said: “Shifting viewing habits have seen the continued growth of the streaming industry which, in turn, has brought new entrants to the sports broadcasting market. New buyers have the potential to increase the competitive tension in rights auctions which is desirable for sports bodies, and the rights to leading sports properties are being shared across a growing number of broadcasters. But as this trend continues, it’s key that the industry considers the additional cost barriers that result from such a strategy. Failure to do so has the potential to amplify existing piracy issues, while some services could see additional subscriber churn.”

Read more Formula 1: Racing Through Video

No comments yet