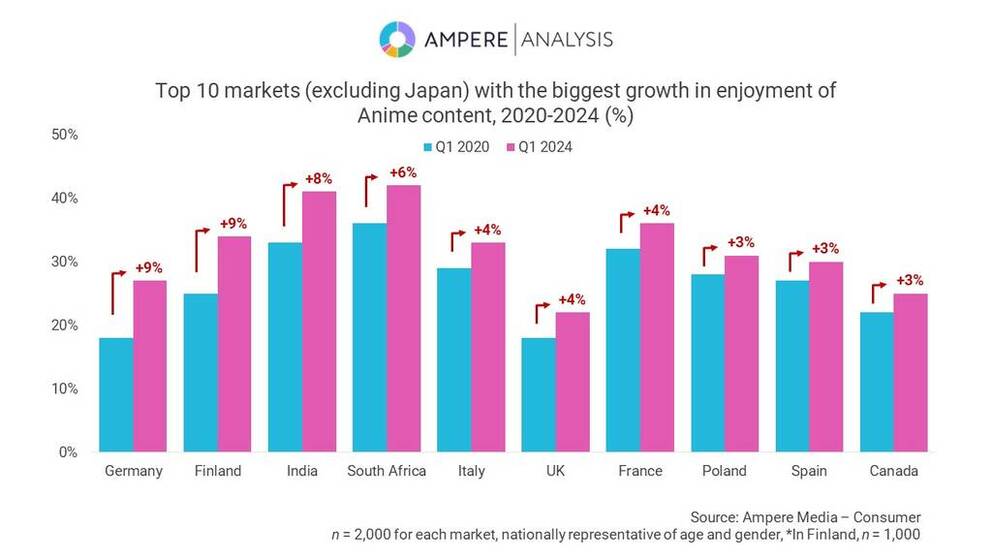

There are strong growth opportunities for Japanese anime in Europe, according to a newly published report from researcher Ampere Analysis.

The report suggests a new wave of popularity for the format is underway in Europe. According to Ampere, Asia Pacific markets such as the Philippines, Indonesia and South Korea still show the highest interest in anime.

However, seven out of the top 10 markets with the largest growth of interest in watching anime are in Europe. They include Germany, Finland, Italy, the UK, France, Poland, and Spain which have seen a 3% to 9% increase in Anime enjoyment in the past five years.

Amid rising interest, available Japanese anime titles have also been increasing in the seven European markets, from 1,945 titles in 2019 to 2,755 titles in 2023, a 42% increase in the past five years. This has been driven primarily by global streaming giants Netflix, Amazon Prime Video, and niche Anime-focused platform Crunchyroll.

Between 294 and 481 new titles were made available in the seven European markets in 2023, but this is around one-third the rate of new titles released in Taiwan, leaving ample capacity for importing new content into Europe.

Meanwhile, Netflix has ramped up its anime offer through licensing and co-production partnerships with Japanese broadcasters and studios over the past five years, successfully growing its anime catalogue from 602 titles in 2019 to 891 titles in 2023 and pushing Japanese content (about half are anime) to the second largest content type by volume on Netflix globally.

Moreover, since April 2024, Crunchyroll has become the single most powerful anime-focused platform in the West in terms of both its Anime catalogue size and subscriber base, due to its merger with anime-dedicated service Funimation, both owned by Sony.

Ampere says that European local and regional services should leverage the building appetite for anime in Europe and the wide availability of content yet to be exploited in the region to gain a competitive edge and achieve long-term growth.

Motohiko Ara, Analyst at Ampere Analysis said: “Japanese anime is becoming increasingly popular around the world and European markets have seen the largest rise in interest. Global anime fans are skewed towards young demographics and those between 18 and 34 years old particularly enjoy the genre. This presents a growth opportunity to current anime carriers including Netflix, Amazon Prime Video and Crunchyroll, and other SVoD platforms in Europe. With anime proving popular with its newly released titles and classic long-running franchises the content provides opportunities both for new customer acquisition and retention.”

You are not signed in

Only registered users can comment on this article.

HbbTV Association formally integrates DRM in HbbTV 2.0.5

The HbbTV Association has published version 2.0.5 of its core specification, which formally integrates digital rights management (DRM). While HbbTV devices have supported DRM for many years, this is the first time it has been explicitly defined, providing a harmonised, interoperable approach across the ecosystem.

Netflix withdraws from race to acquire Warner Bros Discovery

Netflix has withdrawn from the race to acquire Warner Bros Discovery, leaving the way clear for Paramount Skydance to win the months-long battle for the historic Hollywood studio.

UK set to enhance regulation of major streamers such as Netflix and Disney+

The UK's biggest video-on-demand services will have to follow the same content and accessibility rules as traditional broadcasters, under new government legislation.

Avatar: Fire and Ash leads at Visual Effects Society awards

Avatar: Fire and Ash was the big winner at the Visual Effects Society’s 24th Annual VES Awards, taking home seven awards in total, including the top prize of Outstanding Visual Effects in a Photoreal Feature.

Charity publishes set of principles for mentally healthy productions

The Film and TV Charity has unveiled its new ‘Principles for Mentally Healthy Productions’ to help address systemic pressures and poor working practices across the UK screen sector, aiming to improve culture and conditions on productions.