Nordic broadcasters breaking boundaries

As consumers navigate the crowded OTT and linear TV market, traditional broadcasters are also looking to diversify and add value beyond their core offering.

Read the full article

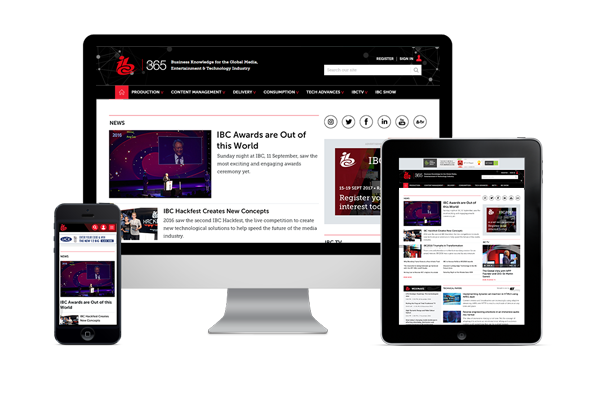

Sign up to IBC365 for free

Sign up for FREE access to the latest industry trends, videos, thought leadership articles, executive interviews, behind the scenes exclusives and more!

Already have a login? SIGN IN