Content Everywhere: a look back at 2023

As the year draws to a close, it seems an opportune time to ask Content Everywhere companies for their views on the top trends in 2023. As always, key industry players have been keen to respond with comments on how the past year shaped up both for them and the ...

Read the full article

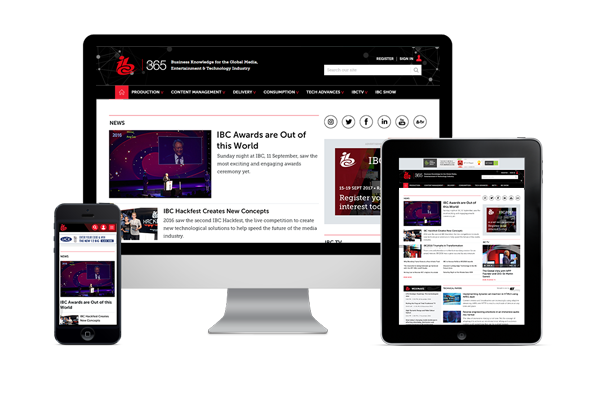

Sign up to IBC365 for free

Sign up for FREE access to the latest industry trends, videos, thought leadership articles, executive interviews, behind the scenes exclusives and more!

Already have a login? SIGN IN