OTT sector growth has resulted in a hugely successful decade for subscription management platform providers. But with competition strong and the prospect of more niche streaming services, they will need to maintain their focus on flexibility, writes David Davies.

Data released by ResearchAndMarkets.com in January indicated that there is no end in sight to the strong year-on-year growth of the global OTT services market. In fact, it is forecast to grow from US$81.6 billion in 2019 to US$156.9 billion by 2024, at a CAGR of 14%. The subscription-based monetisation model segment is expected to expand at the highest CAGR during the five-year period, with Subscription VoD (SVoD) players – including market-leaders like Hulu, Amazon and Netflix – already responsible for more than 158 million paid memberships across 190 countries.

All of which means that OTT continues to provide rich pickings for subscription management solutions providers. Companies such as MPP Global and Cerillion have been active in the space since OTT began to achieve serious traction in the early part of the last decade, generally evolving core platforms to which other options or modules can be attached depending on factors such as geographical reach and billing preferences.

Increased competition means that consumers are likely to review their subscriptions more frequently – hence why ‘dynamic off-boarding’, whereby offers can be made to encourage exiting subscribers to stay with a service, is now a growing priority for OTT providers. But making the subscription process too protracted does risk alienating consumers – in short, it’s a delicate balancing act.

“Do not bite off more than you can chew, and do not make the on-boarding user journey too complex or ugly,” says Chris Welsh, SVP broadcast & OTT EMEA at MPP Global. “You can have a sophisticated architecture, but it must be represented simply to the user in the way that they expect.”

Understanding service specifics

MPP Global’s offer in this space is based around the eSuite subscriber management and billing software. Based around a modular structure, eSuite can be implemented with multiple modules depending on individual service preferences, including Intelligence & Decisioning, Acquisition & Conversion, Identity & CRM, Revenue & Billing, Retention & Recovery, and Analytics & Reporting.

While the specifics of individual services can vary dramatically, the initial planning priorities tend to be relatively uniform. So any new service thinking about its subscription management should “first confirm where the service will be made available; understand what the content proposition is going to be; and understand how the target audience prefers to pay for things.”

The last point can be especially critical given that payment preferences continue to vary significantly by country and by region. For instance, says Welsh, in the “UK and US the percentage of credit card payments is super-high, but in the Netherlands it is super-low – in that country a lot of the first contact tends to be done via iDEAL [an e-commerce payment system introduced in 2005]. Then in Germany options such as Giropay and Klarna are very popular. So you have to think about localised payment reach and the ways that your target audiences prefer to pay” – and that can include billing in local currencies.

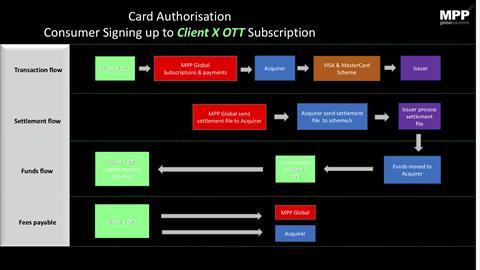

Once the required decisions have been made, subscription workflows normally involve “three moving parts: a subscription engine which takes care of the billing; a housekeeper that is constantly looking for [new subscribers] or renewals to take to the payment gateway; and then a process that leads to the acquiring bank where the revenue ends up.” Streaming services launching across hundreds of countries might be best advised to secure international acquiring licenses, although there is evidence that regional acquisition licenses can result in higher success rates.

“Do not bite off more than you can chew, and do not make the on-boarding user journey too complex or ugly,” - Chris Welsh

With competition set to intensify in the coming months – NBCUniversal, WarnerMedia and Quibi are just three of the organisations launching VOD services in 2020 – analytical tools that can guard against churn remain fundamental to effective subscription management. MPP views churn “in three ways: voluntary churn, involuntary churn and predictive churn,” says Welsh.

Enabling broadcasters to have a deeper understanding of viewer behaviour and, in particular, the factors that make consumers want to cancel their subscriptions has had a notable impact on the development of anti-churn measures, for example dynamic off-boarding. Hence the customer who signals their desire to exit a service may be presented with “a multiple choice question about why they want to leave, and if they select the option relating to payment they can be presented with offers in the cancellation flow, such as a discount for the next three months.”

Dynamism and differentiation

Digital marketing, publishing and healthcare are among the diverse markets in which Cerillion’s Skyline subscriptions management platform has achieved traction since it was launched in 2013. It has also proven popular among streaming services, with marketing director Dominic Smith observing a distinct trend in basic requirements as the sector has expanded.

“If you have a ‘one size fits all’ service then it might be that a straight recurring payment is the main element you need, along with the capability to manage the subscription lifecycle from [on-boarding] new customers to managing them on a recurring basis throughout that lifecycle,” says Smith. But as OTT competition intensifies, this kind of blanket approach becomes less tenable; instead, streaming operators are obliged to think more strategically about “how they package and sell their services”.

Going forward there are likely to be two primary ways in which OTT providers differentiate their services. One will be dynamic usage, “where rather than pay a fixed price per month, you are being charged on what you actually use.” The other will be content, with Disney’s pulling of content from other platforms ahead of the launch of its own Disney+ service in November 2019 being a case in point. “If you have unique content then that can be your main differentiator.”

If customer loyalties are likely to be more fluid in the future, then it’s unsurprising that Smith also highlights the continuing development of analytics tools. Increasingly, this entails deeper integration with other service platforms: “There is a requirement to enable not only analytics on the platform itself, but also integration capability that allows the data to be [consolidated and processed] with data from other systems such as logistics and fulfilment.”

Crisis viewing

Prior to the coronavirus crisis there was increasing talk of ‘subscription fatigue’ confronting the video streaming sector (indeed, Cerillion described it as “a growing bane” for the industry in an April 2019 blog post). In the short-term this is certain to become a secondary concern as enforced lockdowns lead the vast majority of people to view more content on a weekly basis than would otherwise be the case. Post-crisis it could be a whole other story – and one in which subscription flexibility is even more pivotal.

“The current lockdown is undoubtedly driving some growth in demand for these services,” agrees Smith. “However, the longer this situation continues the more financially constrained people will become – and therefore more likely to look at their bank statements and consider how much they are spending and which services they are using the most.”

In this context operators will need to ensure they offer plenty of options with regard to tiered or downgraded memberships. But intriguingly, Smith also feels that Covid-19 could have an effect on the actual type of OTT services that emerge over the next few years: “You only need to look at the fitness content that has sprung up to see how quickly people can innovate and things can change.” So expect “more fragmentation” as niche providers – quite possibly working with new and more fluid payment mechanisms – emerge to co-exist with the major global platforms.

No comments yet