The first-stage announcement about the 2018 English Premier League auction for TV rights this week underlined the end of an era: the days of hyperinflation for EPL rights are over, at least for now.

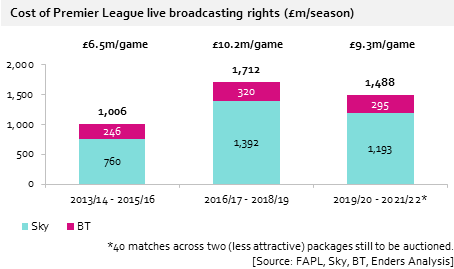

The cost to screen these football games rose by 70% three years ago to just over £5 billion, but the three seasons from 2019-2022 seasons will probably end up being priced about the same once all seven packages are sold.

Sky was the big winner as details of the first five EPL packages emerged and BT Sport also came out of the auction smiling, while mystery surrounded who would buy the final two batches of games.

Speculation focused on whether the initial bids were too low for groups of games that always looked the least attractive and if one of the digital giants like Amazon was involved in negotiations.

Deal detail

Sky’s negotiators were very happy to have bought 128 matches (two more than the previous auction) across four different packages for a total of £3.579bn; last time, their 126 matches cost £4.1bn. The rules of the auction stated no bidder could have more than four of the top five packages, so Sky got exactly what it wanted and for a bargain price.

Sky Sports will show “first pick” matches every weekend for the 2019-2022 period at the most coveted and most costly kick-off times.

The full breakdown is:

- 32 matches on Saturdays at 5.30pm

- 32 games on Sunday at 2pm and a further 32 at 4.30pm also on Sunday

- 8 games on Saturdays at 7.45pm

- 24 matches either on Mondays at 8pm or Fridays at 7.30/8.00pm

The Saturday evening games will pit the Premier League against prime time shows across the TV landscape on a regular basis for the first time and analysts will be looking very closely at both the viewing figures and the level of commercial uptake.

Meanwhile, BT has shelled out £885m for 32 matches (10 fewer than last time) at £295m a year.

All its games kick off at 12:30pm on Saturdays and, of these, 20 will be “second pick” of the weekend’s most attractive games and the other 12 will be the “fifth pick”.

“Financially responsible” was how BT Sport described its bidding strategy and Sky said the same thing, calling theirs “a disciplined approach”.

Both companies have long accepted that broadcasting football is a loss leader. Analysts see the EPL as a major reason why Sky continues to hold on to most of its near 13 million plus subscribers in the UK and Ireland - little or no live football is Sky’s nightmare scenario.

Meanwhile, BT created its sports channel to pump up its broadband numbers and that’s also a business strategy that has worked for them.

This outcome re-established Sky once again as the destination channel for EPL, while BT Sport picked up enough decent games to please its subscribers. The main point was that both channels gambled and won when it came to the price they paid.

There had been recent indications that the immense fees of the last two auctions were not likely to happen in 2018 because the rights costs were eating into the overall profit margins of both broadcasters.

EPL auction revenue for UK packages had grown from just under £1.8 billion in 2009 to £3 billion in 2012 and then to a massive £5.1 billion three years later, but another similar leap was basically unaffordable.

The £1.193bn cost of EPL football per annum to Sky now amounts to a £199m annual saving, a 16% cost reduction per game, and the city loved this news: Sky shares rose by 3% on the day of the announcement, more than when news of the 21st Century Fox potential purchase emerged.

Despite BT Sport slightly increasing its per-game costs this time around, their 2018 numbers also look more balanced.

BT’s share price showed little movement after its EPL deal despite the company’s statement saying it is “in a strong position to make a return on this investment through subscription, wholesale, commercial and advertising revenues”.

Buying just one of the five main packages meant BT Sport showed how vital it was to grab Champions League and Europa League coverage on an exclusive basis and give them a significant football USP.

However, Sky’s position of actually paying less money for more games is the breakthrough and a signal to the EPL that it has to consider new auction tactics of its own in future. Analysts had predicted a cooling off about EPL’s TV rights, yet there were few predictions of actual reductions. Still, the signs were there.

The two broadcasters had been making public statements about lack of feverishness over the 2018 packages and they even negotiated a deal in December to allow their matches to be shown on each other’s channels, something that allowed them to hedge against the possibility of being obliterated in this auction.

Were there even discussions between Sky and BT Sport executives about their bidding preferences for this year? Unlikely, but both ignored previous bidding history and maybe that was just sound business reasoning by both companies who listened very carefully to each other’s public statements.

“It was certainly a risk for both broadcasters to bid low like this,” said Richard Broughton, research director at Ampere Analysis, “but they each won and it’s probably in everyone’s interests including the EPL’s who, of course, want short term benefits, but they can see long term how these high fees eat into the profit margins of their TV partners.”

Read more Who watched the Super Bowl?

The digital giants are coming

The pre-auction chatter about involvement from Facebook, Amazon, Apple, Netflix or Google (one analyst even speculated about interest from Liberty Global) is still ongoing given two packages still being negotiated.

The league made little effort to quell any FAANG rumours and why should they when such speculation might encourage higher bids from others? But analysts were always sceptical that this was the right time or the right sport for global digital companies to spend large amounts of money.

Of course, with a $3 trillion combined market cap, FAANG are not short of cash, but live EPL games have a limited shelf-life and relatively low appeal on these platforms, according to Enders Analysis, although Amazon - the most likely EPL bidder - would make great use of a database of football fans with its full retail portfolio. Others, like Facebook, would enjoy more eyeballs to its platform and, thereby, its advertisers, but at what price?

Two more packages

For sure, if one of Facebook, Apple, Amazon, Netflix or Google bought package 6 or 7, then the others would be happy and know better what to do at the next auction in three years’ time.

However, the final two packages on offer are less attractive even Sky and BT Sport because many of the games are played concurrently.

Package 6 is 20 matches from one Bank Holiday and one midweek fixture programme, while Package 7 is 20 matches from two midweek fixture programmes. The delay in announcing the sale means there is definitely bidding competition, but it also probably indicates low bids.

Also, it might be that new bidders such as the FAANG or a commercial broadcaster like ITV or even Channel 4 are asking a few difficult questions and negotiating harder.

The ideal buyers of the last two packages for the EPL is one commercial broadcaster and one FAANG or even some kind of partnership. This would offer the larger audiences of an ITV along with the excitement of broadcasting live on a digital platform for the first time with the potential of more and maybe younger fans.

Once the final two UK broadcast packages are sold then that leaves the international rights (worth around £1 billion) and the near-live mobile rights (held by Sky for an unknown amount) which will both be negotiated at a later date.

So, despite no massive rights increase, this auction keeps the EPL as easily the world’s richest football league.

Add in final two package sales and total EPL auction income should be around the same as in 2015.

By contrast the German Bundesliga’s last TV rights deal was for €4.64bn (£4.13bn) over four years, while Amazon struck a $50mn (£35mn) deal with the NFL for (non-exclusive) streaming rights to 10 Thursday Night Football games last year while its upcoming Lord of the Rings TV adaptation will cost just $1 billion for six seasons.

It seems the EPL’s golden goose is not dead yet.

Webinar on demand Remote production: Game changer for sports broadcasters

1 Readers' comment