Free Ad Supported Streaming TV (FAST) is quickly becoming the content model of choice for viewers and brands alike, according to the third edition of Amagi’s industry report. FAST performance is accelerating across the globe, driven by subscription fatigue and consumers’ growing demand for linear viewing experiences.

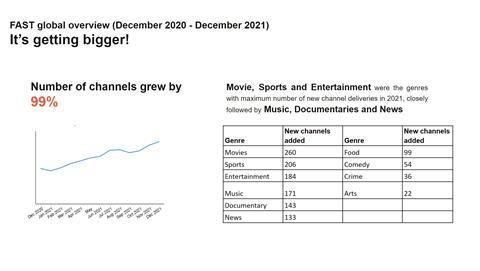

The report analysed year-on-year growth of total hours of viewing (HOV) and ad impressions between December 2020 and December 2021, across 2000+ channels on 50+ FAST platforms on the Amagi Analytics platform. The report revealed 99% growth in the number of channels, 134% growth in ad impressions, and 103% growth in viewership hours on the Amagi platform.

With subscription fatigue on the rise, 4.5 million consumers cancelled their streaming subscriptions in Q3 of 2021, reducing streaming penetration to 85%. Meanwhile, FAST services have seen a 15% uptick in the last two years, with 53% of viewers regularly tuning into FAST channels, according to Hub Entertainment Research.

“We expect 2022 to be a big year for innovation in the FAST universe – across programming, advertising and distribution,” Srinivasan KA, Amagi

“With the remarkable rise of FAST TV, we’re seeing the promise and potential of ad-supported models begin to come to fruition,” said Srinivasan KA, Co-founder, Amagi. “Consumers are exhausted by the cost and overwhelming choices of subscription services. Increasingly, they are clamouring for linear, ‘lean back’ viewing experiences across a wide range of genres – and our latest FAST report reflects that clearly.”

FAST content is exploding

Global content brands are entering the FAST space at a rapid pace, adding a wide variety of mainstream and niche genres to the mix. While news continues to be the most sought-after content on ad-supported platforms, FAST channels are also offering audiences everything from movies, documentaries, music, horror, crime, food, travel, anime, sports and more. In 2021, the genres with the greatest increase in channels were movies, sports and entertainment, closely followed by music, documentaries and news, reflecting their popularity among consumers in this increasingly crowded space.

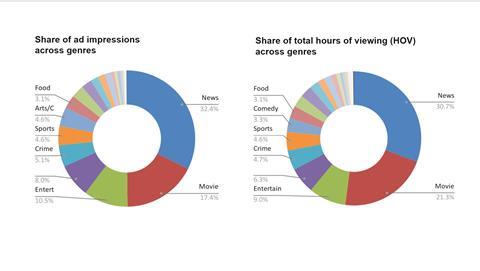

Audiences are shifting to ad-supported linear TV – and all signs suggest they want more, according to the report. In 2021, total FAST viewership hours grew by 103%, while the average session duration increased by 8%. Clearly, viewers are watching more and engaging longer, especially with top-performing genres like news, movies, entertainment, crime and sports. And, in a trend that’s picking up speed, viewers are increasingly watching FAST TV via their mobile devices, in addition to connected TVs.

103% Growth in FAST viewership hours, 2021

FAST ad revenues on the rise

Ad-supported streaming platforms are starting to see steady growth in their ad revenues. As FAST services like Pluto TV and Tubi continue to up the game by investing in quality content, bringing audiences with them, advertisers are clearly following. In 2021, ad impressions grew by a robust 134%, reminding us of the $50 billion in ad opportunities up for grabs for content owners each year across FAST platforms.

“As brands enter and expand into the FAST space at a rapid rate, competition is only growing fiercer. Our latest industry report confirms that continued investment in FAST remains essential,” added Srinivasan. “We expect 2022 to be a big year for innovation in the FAST universe – across programming, advertising and distribution – and will continue to report the data-backed insights content owners, streaming platforms and advertisers need to stay ahead in the streaming game.”

This edition of Amagi’s FAST industry reports aggregates data from its proprietary platform, Amagi Analytics, on viewership and content monetisation trends. It covers insights on top ad-supported platforms across the US and Canada, EMEA, APAC and Latin America for 2021.

- Read more Driving FAST changes in OTT

No comments yet