Back in 2019, Netflix released data claiming that 45 million accounts – nearly a third of its total subscribers – had streamed the Sandra Bullock thriller Bird Box in its first week on the platform, a record for a Netflix film.

At face value that statistic was extraordinary. All things being equal, had the Susanne Bier-directed film been released in cinemas, it would have racked up nearly half a billion pounds in just one week based on an average ticket price of £10.

That record has since been surpassed by the 2021 comedy action movie Red Notice, which notched up 328.8 million viewing hours and has been seen by over 50 percent of all Netflix users. As reported by Screencrush, Bird Box took four weeks to rack up its 282 million viewing hours. In contrast, Red Notice surpassed that total in just 18 days.

It was proof of the soaring demand to stream movies at home and equally of the importance to streamers of securing original must-see content.

As for the effect on traditional moviegoing… There was a point in 2020 when the pandemic appeared to have killed off cinema. Theatres were shuttered globally and indefinitely. Productions were mothballed. What new content there was was ushered straight to streaming platforms in a model that seemed to have hastened the slow but inevitable demise of exhibition for that of the more convenient home box office.

It called to mind a comment by Reed Hastings, CEO of Netflix, who once remarked that the only innovation cinemas had to offer was better-tasting popcorn.

Audiences are coming back to cinemas

You can argue that Covid-19 has been a blessing in disguise for those in the exhibition business and for anyone who loves the romance of viewing a new film on a big screen in the company of strangers.

The experience of the last couple of years has proven that far from being the new medium for releasing feature length entertainment, streaming platforms are often second best behind good old-fashioned visits to the cinema.

This is nothing to do with sentimentality and all about following the numbers, which dictate that cinema remains the best place to first release your blockbuster.

“The bigger a movie succeeds in the cinema, the bigger it is on the auxiliary markets”

The strategies of Hollywood studios that had collapsed the windows between exhibition premiere and release to the home have been systematically reappraised in favour of cinema once more.

At cinema exhibitors event CinemaCon in April, John Fithian, CEO of US Theater Owners trade body NATO went so far as to claim that: “Simultaneous release is dead as a serious business model and piracy is what killed it… evolving periods of exclusivity maximise revenue and increase perceived value to consumers. Theatrical windows grow our entire industry.”

A shift to shorter theatrical windows

Piracy is certainly one issue which has caused studios to rethink digital only releases. The Motion Picture Association calculates that pre-release piracy can syphon as much as 20 percent of box office revenue.

But the main reason for the about turn lies in the cynical but evergreen evaluation that a movie released to cinema generally turns over more than its weight in dollars returned.

For example: during its 45-day exclusive theatrical window, The Batman earned $760 million at the worldwide box office, nearly $370 million of which came from the US.

It was the first Warner Bros. movie in more than a year to be released exclusively to theatres after the studio debuted all of its 2021 films simultaneously on HBO Max.

While The Batman is now streaming on Max, the shift is representative of the other major Hollywood studios, which largely seem to be moving away from ‘day-and-date’ releases as they’re called, in favour of exclusive, but shortened, theatrical windows.

- Read more: Behind the scenes on The Batman

“The exclusive window is in the interest not just of the exhibitors but the studios,” Mooky Greidinger, CEO of UK-based Cineworld theatre chain, told Business Insider. “The bigger a movie succeeds in the cinema, the bigger it is on the auxiliary markets.”

Cinematic releases add crucial cultural value

In fact, Warner Bros. Discovery CEO David Zaslav emphasised during an earnings call in April that he’s not ready “to really collapse the entire motion picture business on streaming.”

He said, “When you open a movie in theatres, it has a whole stream of monetisation. More importantly, it’s marketed. It builds a brand so when it does go to a streaming service there’s a view that (the title) has a higher quality that benefits the streaming service.”

”In the first half of 2022 there were 61.7 million cinema admissions in the UK, almost a five-fold increase (or 488% more) compared to the same period in 2021.”

In other words, the only way to really add value to IP is to make your product have cultural impact. If the movie comes and goes on a streaming platform without the fanfare and attention of cinema release it will lack crucial value.

“That tells you everything you need to know, about how we feel about windows, and that windows work,” Sony Pictures Motion Picture Group President, Josh Greenstein told Deadline. “Our biggest movie ever [Spider-Man: No Way Home] had the longest window. “Windows are critical to the success of all our films and the IP.”

Can cinema’s revival be sustained?

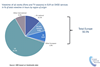

Global cinema box office has resuscitated since nearly expiring in 2020. Last year, global box office attained $21.4 billion, according to researcher Gower Street Analytics, representing a 78% gain on 2020. But that cumulative was less than half of the $41.3 billion average of the three pre-pandemic years 2017-2019.

The numbers are still going up. The UK and Republic of Ireland box office total for 2021 was £602 million, 144% up on 2020, in figures supplied by the BFI. In the first half of 2022 there were 61.7 million cinema admissions in the UK, almost a five-fold increase (or 488% more) compared to the same period in 2021, 72% more than H1 2020 (and 26% lower than the first six months of 2019).

It’s not as if Gen Z are immune to cinema’s charms either. Some 42 percent said that they plan to go to the movies more in the months ahead than they did pre-pandemic, according to a Morning Consult survey.

Yet there are two threats facing cinema exhibition’s survival. One is structural and baked into the new balance of the distribution ecosystem. Streaming hasn’t gone away and studios are going to use the platforms they own to cherry pick and experiment with release strategies on a film-by-film basis.

The average 90-day window reserved for theatres has shrunk to 45 in most cases, with just over two weeks for titles with less commercial appeal or aimed at specialty audiences.

Where are the must-see movies?

The other problem is hopefully more short term but it’s causing the biggest slump in global box office just now: There aren’t enough good films – or films full stop – being released.

Cineworld nosedived in trading by 57.6% this week after reporting disappointing ticket sales. The company, which owns America’s second-biggest theatre chain, Regal, posted a net debt of $8.9bn at the end of 2021, vs. revenues of $1.8bn

“Despite a gradual recovery of demand since reopening in April 2021, recent admission levels have been below expectations,” the company told investors. Those lower levels are tied to a limited film slate that’s expected to continue until November.

Recent releases including Brad Pitt’s Bullet Train have not only failed to set the box office alight but contributed to an alarming box office slump. It prompted Variety to ponder whether everyone had gone on vacation?

“A big reason theatrical doesn’t quite feel ‘back and better than ever’ is because of the sheer lack of theatrical releases being offered,” concludes Forbes.

Cinema vs streaming: An uneasy alliance

Several tentpoles in the last eight months like Free Guy ($330 million), Godzilla Vs. Kong ($469 million), Spider-Man: No Way Home ($1.9 billion), Everything Everywhere All at Once ($84 million) and Top Gun: Maverick ($900 million-and-counting) “have overperformed pre-Covid expectations” but a lack of “regular mid-level theatrical product” – decent indie movies or second string studio fayre - is one reason that ticket sales this summer are far from stellar.

Some of that “mid-level theatrical product” is choosing streaming over cinema, particularly if a project is one that studios decide is uncommercial in subject matter or treatment.

Directors, cinematographers and editors also seem to enjoy a creative freedom at Netflix, Apple TV+ or Amazon outside the executive confines and stricter schedules of a studio major; an indie mentality with blockbuster budgets, if you like.

It explains why Guillermo del Toro, a classic Hollywood outsider, has chosen to follow his Oscar winning The Shape of Water with an animated feature version of Pinocchio for Netflix. While Martin Scorcese’s U$100 million gangster movie The Irishman was picked up by Netflix when original studio, Paramount, got cold feet.

- Read more: Go behind the scenes on The Irishman

There’s still the post-Covid unwinding of production schedules, which saw films delayed and Forbes notes that a number of second string studio movies that might once have been headed to cinemas are now moved direct to streaming (among them: Jennifer Lopez’s Shotgun Wedding, Warner’s Father of the Bride remake, 20th Century Studios’ Good Luck to You, Leo Grande – a digital release in the US).

“All of this combines to create a scenario where the biggest threat to theatrical isn’t Covid, but rather the lack of theatrical movies.”

For more on the state of streaming vs cinema, read the following articles:

1 Readers' comment