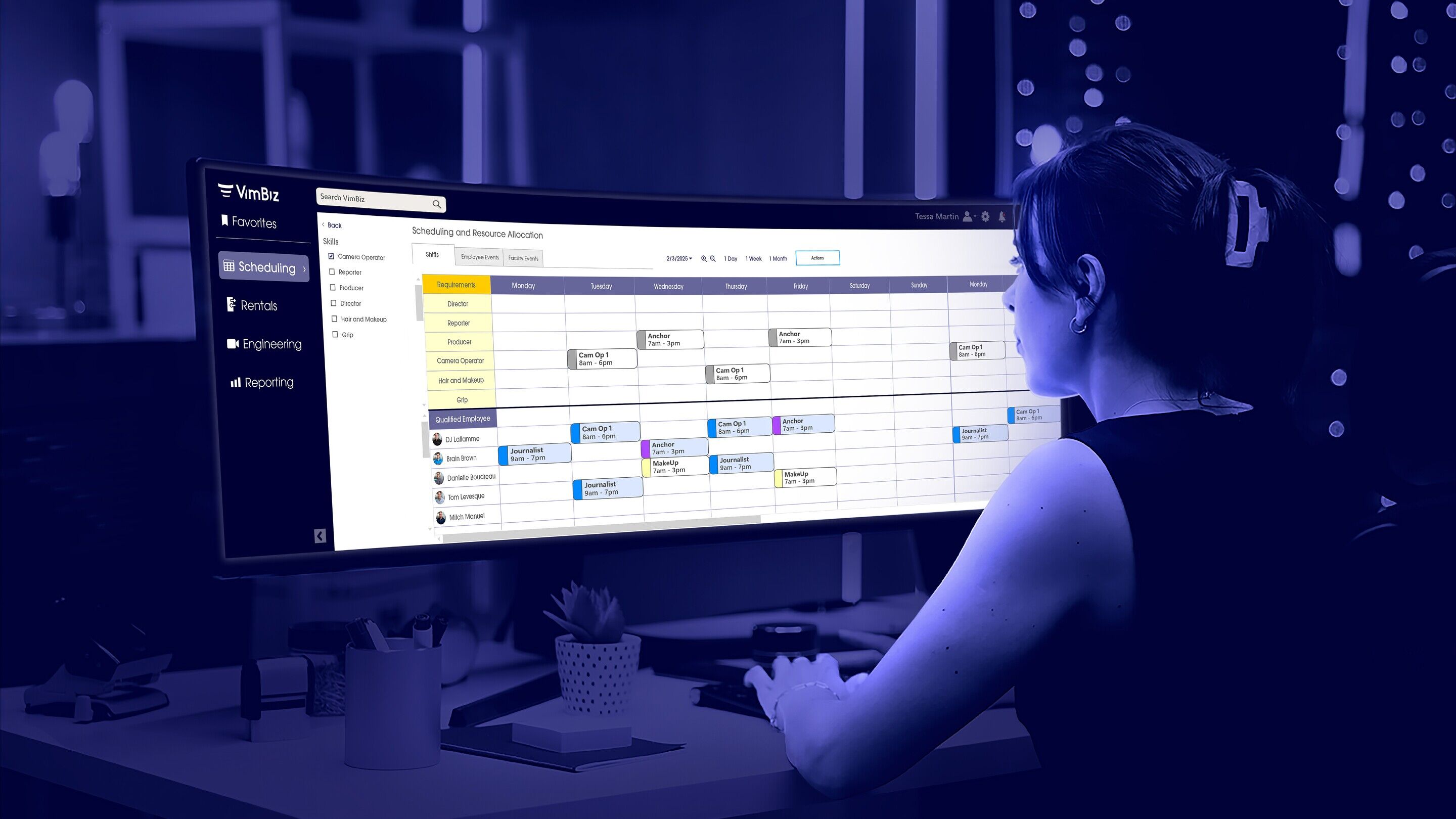

Tutorials

AI – Tutorial, Ep 2 – The AI Implementation Compass: Going from innovation to transformation

Tutorials

Connective tech – Tutorial, Ep 1: Technical integration in the cloud – enabling media workflows that work

Interview

ISE 2025 – Spiro Plagakis: “They like that they’re able to use a combination of broadcast and proAV equipment easily”

Interview

ISE 2025: Kari Eythorsson explores innovations in software services to create and provide content

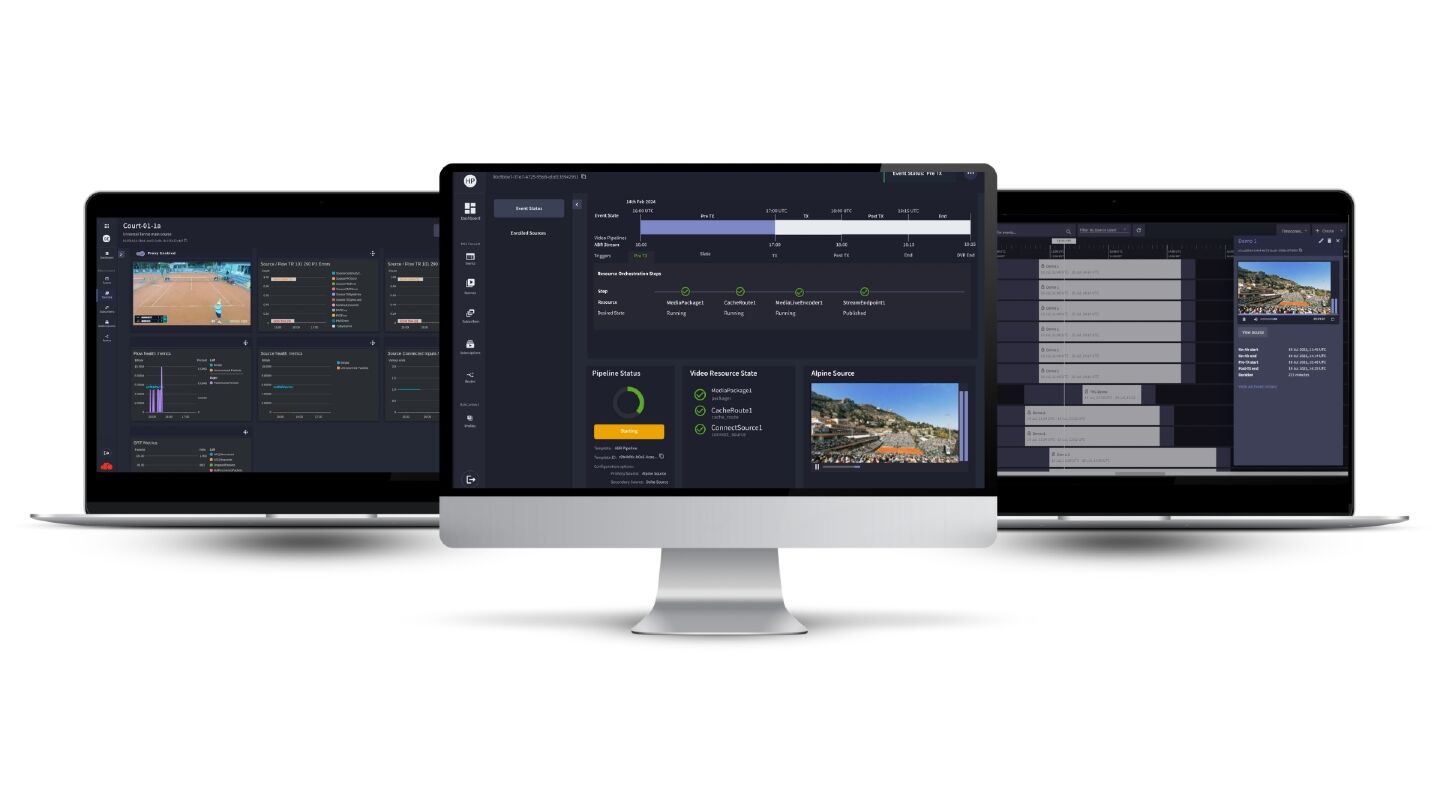

IBC Show VOD

Zattoo launches a powerful suite of tools to power the next generation of global streaming services

Opinion

.jpg)

.jpg)

.jpg)

.jpg)