With streaming service subscriptions in decline in some established markets as the cost of living crisis worsens, it’s likely that the industry will have to take a fresh look at content aggregation, writes David Davies.

After an extraordinary and extended period, it was always inevitable that the streaming sector would reach a plateau. But the degree to which this has occurred in some mature markets during the last 18 months – underpinned, no doubt, by a severe cost-of-living crisis – will have taken many observers by surprise.

In the UK, for example, a Kantwar Worldpanel survey revealed that households had stopped paying for nearly 170,000 streaming services in the first three months of 2023 as more budget-conscious consumers undertook a post-Christmas ‘subscription cull’. Netflix was shown to be particularly affected, recording the largest loss in absolute subscriber numbers in the UK, despite the introduction in November last year of a cheaper, ad-supported tier.

There is no doubt that, along with growing economic worries, the loss of content to more single media organisation streamers has negatively impacted the appeal of the original streaming giants. But there are reasons to be concerned about those services, too; for example, Disney+ announced in early August a fall in worldwide subscriptions from 157.8 million worldwide to 146.1 million – a loss of 11.7 million, which is more than double the previous quarter’s record decline. In more recent days, the service has announced a new ad-supported tier in a bid to bolster its fortunes.

Read more Beyond DAI: How Dynamic Ad Insertion is optimising revenue and viewer engagement

All of which has fueled the suggestion in some quarters that streaming will have to identify a new model if it is to remain prosperous, especially in markets that have already acquired a significant level of maturity. In essence, this means that it’s probably time to revisit content aggregation and see if it can be made to work for a sector that is only becoming more competitive as the ‘battle for eyeballs’ intensifies.

Beware of complexity

While the current economic cycle has highlighted the drawbacks of streaming fragmentation, it’s not as if this issue hasn’t been underlined by viewer research on a number of previous occasions. For example, it’s clear that the more services viewers feel compelled to subscribe to – which could in some cases be driven by a desire to see a single series or exclusive movie – the lower their overall satisfaction.

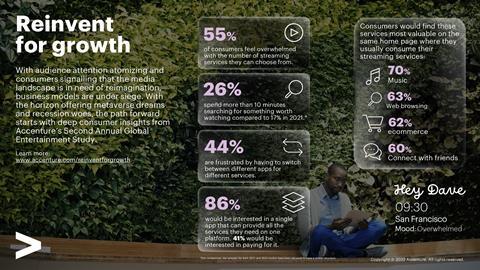

Andy Walker is Global Communications & Media Industry Lead at Accenture, which recently produced a research report, Reinventing for Growth. The report suggests M&E businesses could focus on one or more of three primary roles in order to build growth: aggregators, audience cultivators or content merchants, summarising: “Standalone streaming services are running up against some simple facts: there are limits to what consumers will pay for, and only a certain amount of complexity and number of options that they are prepared to deal with.”

Expanding on the theme, Walker said that research consistently shows that “when customers have 1, 2 or 3 streaming platforms they are pretty happy. Three is the tipping point and with every platform added after that, the satisfaction with all the platforms drops. I do think it’s pretty clear that the model will have to change as [the industry] can’t keep going down the road of there being 5 or 6 [major] sites out there. My observation is that the streaming services are thinking about how to better monetise their content in the future, but they all seem to be proud of their platforms and are unlikely to surrender them easily.”

Lior Friedman is SVP business development at media cloud solutions provider Amagi, which in April announced the launch of a FAST (Free Ad Supported Television)-related service, Amagi Connect, that allows content owners to connect with platforms via a self-service online marketplace. As Friedman noted, “barriers to entry” have gone down significantly in recent years, but with the growth in services “comes fragmentation of distribution, and finding viewers is increasingly challenging. Two main challenges that come with that fragmentation are discoverability and engagement of end-users with content on various end platforms, and the need to adapt to different media supply chain workflows.”

It may well be special features and bespoke content that initially draw consumers to a streamer, but it’s clear now that “exclusive and unique are not enough”. This is one reason why FAST channels are becoming so popular, said Friedman: “They have become a great way to overcome these challenges, while maintaining a sense of control that the content owners have over viewership, business terms and monetisation. This is where aggregators can support with augmenting the core, proprietary offerings with additional content and features.”

It is evident that Friedman sees FAST services as being an integral component of streaming’s next phase. “The trend growth in FAST viewership demonstrates that viewers want to avoid the paradox of choice and infinite scrolling,” he said. “To them, it’s about the quickest way of finding what to watch, and not where the content comes from. While aggregation of content (which, by definition, is non-exclusive) may not be the solution to every viewer’s need, it does meet a wide range of use cases that are key for user engagement and retention. [Meanwhile] resurgence of known content brands and franchises in theatrical releases demonstrates that, during times of uncertainty, viewers may be far more open to watching brands they know and are familiar with, rather than discovering something brand new.”

He is sure that there will continue to be an important role for aggregation in the future: “Content aggregators with a wide footprint in terms of platform and content partner integration are key to offering content discovery, metadata enrichment and personalisation, engagement and viewership analytics at scale.”

Co-existing and co-operating

Steve MacMurray, Digital Media Development Manager, Globecast, readily admitted that it can be challenging to predict what will happen next in this business: “We don’t have a crystal ball in the media and entertainment industry, and you never know 100% what will catch fire.”

Nonetheless, he continued to suggest a few ways in which aggregation could develop in the coming years. “It’s possible that the smaller individual content aggregation services will be subsumed into larger content services as they face increasing pressure from the dominant players in the industry. More attractive deals could be possible, offering higher revenue share, better exposure or exclusive partnerships. This could result in more consolidation and convergence in the content market, as well as more convenience and simplicity for the users. [Alternatively] the pendulum could swing the other way, with the smaller individual content aggregation services remaining independent and competitive as they leverage their unique features, niche audiences or innovative technologies, and differentiate themselves from their more sizeable competition.”

In a fragmented market, it could be that the scope for smaller, more responsive service providers is increased. As MacMurray observed: “Smaller maybe actually translates into agile, and with that the ability to offer more diversity, personalisation or interactivity to users, as well as more flexibility and autonomy to their content providers.”

However, a ‘third way’ could be for aggregators of all sizes to take account of the broader economic landscape and see if they can work together more collaboratively. “In pursuing mutual benefits and synergies, there would be room to provide complementary or supplementary content to the bigger players, or vice versa,” he said. “Data, resources or platforms could be shared to improve content quality, discovery or delivery. Partnerships can drive more integration and innovation in the content market, as well as deliver more value and satisfaction for the users, with less churn. When you factor in a cost of living crisis, consumers are more careful about juggling multiple subscriptions, and a more collaborative approach between service providers may be a sensible approach to ensure survival.”

5G potential and Occam’s Razor

MacMurray also pinpointed a few newer technologies as potentially being enablers of different approaches to aggregation, including 5G. “Fuller integration of this technology into the content aggregation world will enable faster and more reliable access to content,” he said. “Users will expect more diverse, personalised and interactive content that can leverage the capabilities of 5G. [It will also] enable content aggregation to incorporate more types and formats of content, such as 3D, holographic, haptic and spatial audio. [There will also be support for] more languages, cultures and perspectives, as 5G will facilitate cross-border and cross-cultural communication and collaboration. Content aggregation will become more dynamic and adaptive because 5G will allow for real-time feedback and interaction between users and content.”

All of which will herald some exciting opportunities for viewers and content creators, the latter needing to think evermore carefully about differentiating their offers. In which context, no one can lose sight of the importance of ensuring the user interface remains simple and intuitive.

“What’s critical for the end viewer is the user interface,” confirmed MacMurray. “Multiple different UIs, passwords, navigation and juggling subscriptions can all be confusing barriers in the search for meaningful content. Any tech operator, whether domestic or professional, benefits from the Occam’s Razor approach: the application of abductive reasoning. In other words, keep it simple!”

Read more Content Piracy: Increased Industry Collaboration and Viewer Conversion Needed

No comments yet